At the moment, AMP Bank is offering the highest 5 year term deposit for a minimum of $25,000 for 4.15% p.a. If you have a minimum of $5,000, it will be 4.1% p.a for 5 years term. Not a bad offering considering current online savings account rate is less than 2%. Interest paid at maturity.

5-Year Term Deposit: 4.15% p.a Minimum $25,000 Deposit, 4.10% p.a. Minimum $5,000 Deposit @ AMP Bank

Related Stores

closed Comments

- 1

- 2

Yeah, sounds like AMP are banking on the RBA providing plenty of increases over the next 5 years in order for this deal to work in their favour.

Technically a "deal" currently, yes, but not when considered over the 5 year term they're requiring.

More than a decade ago, Westpac offered 8% p.a for 5 years term. At that time no one is expecting the rate will be going down, then a few months later, the rate kept going down. Should save more at that time. Great time for cash holders.

Doesn’t this work against your argument?

@LittleTicket: Never put your egg in the same basket. At the moment, almost all experts will predict that interest rates will be going up. But how high and when ? If you have the money and some backup cash (for emergency) and would not need it for 5 years, I would put it in this TD. Also put your egg in share, ETF, managed funds, etc. When 2.5 years later, the TD rates shoot to the roof to more than 4.15% + 0.5%, I would early withdraw and reinvest, thus you won't loose the penalty.

@yht: you can't withdraw early from a TD without incurring a break fee. Especially if interest rates go up.

Got a link for that? I thought at 2007/2008 the banks were only doing 7%?

@serpserpserp: I don't have a link but I also got 8.25% on my first ever term deposit through ANZ in about 2007-8.

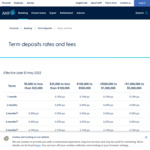

Here is the full rage of AMP deposit terms and rates

They start from just $5,000

Note the rates rise very quickly up to a 2 year term then rise more slowly up to 4 years (HINT!!!)

https://www.amp.com.au/banking/term-deposit/rates-and-fees

But don’t you have the flexibility? Penalty for early termination is only 50bp and need to give 31 days notice.

So basically you could get 3.65% interest for a rolling 1 month term deposit unless im missing smt.

Exactly right, but they can change the penalty, I’m just not sure if they need to give advance notice to allow an opportunity to terminate.

^ This! People need to understand it does NOT have to be the entire 5 years locked in. Always check the penalty for early termination and calculate the worst scenario (i.e., very early withdrawal) and see how much interest you'll be effectively earning.

Rate wise this is so much better than the crap online savings account, if you have the money and willing to spend the time.

They won't tell you how the interest is adjusted if you withdraw earlier. They got annoyed when I asked them again, they said they could only tell me if I already have existing TD. It makes no sense, al other banks tell you clearly how they calculate interest adjustment. I suspect they charge you additional fee, I don't like that dodgy practice.

@izkai67: I'm not even sure if it's legal for them not to tell you, if it is it shouldn't be. As a business they should want some certainty in how much they charge if you cancel and video versa. I'm not a big fan of making simple important information like that hard to find. It should be in a CIS document if they even exist for these.

@izkai67: If you leave early, they'll reduce the effective rate, depending on what % duration you've stayed in the TD (Deposit products fees and charges guide section 1.6):

* Duration < 25%, = 0.5% reduction

* 25% <= Duration < 50%, = 0.4% reduction

* 50% <= Duration < 75%, = 0.3% reduction

* 75% <= Duration < 90%, = 0.2% reduction

* 90% <= Duration, = 0.1% reduction

See also T&C - Section 7.2.4 Early withdrawals from your term deposit.So in theory you can setup a 5yr TD @ 4.15%, but exit after 6mths (=10% duration) at 4.15-0.5 = 3.65% (well above what they're offering for a 6mth TD (2.15%)). This sounds pretty reasonable then.

The catch is they can change those reduction% values in future, but will give you ('at least') 30 days of notice (T&C - Section 8.4.1 What happens if we vary these terms and conditions?) even though you must give 31 days of notice if you want to withdraw early (link). Effectively this means you'll have to cop whatever reduction% they change to, as you'll be unable to exit quickly enough… which seems kinda dodgy.

Even so, am considering this.

@jimijam: What if you give them notice of early termination the day after your annual interest payment? Would you still get to keep the 4.15% they've already paid you for your first year?

"The amount of interest rate adjustment applied for early withdrawals from term deposits will vary from time to time, at our sole discretion"

You can bet that will be changing.

Also "Withdrawals from a term deposit are not permitted during the term, except where we agree to your request for a full or partial withdrawal before the end of the term."

Spot on. Exit fees will be higher as rates start to increase

except where we agree

And if they don't agree? Legally they can.

Uncle Roger say correk

but you can withdraw early if that's the case?

by law, yes, you should be able to withdraw early, but I suspect amp'll charge unreasonable fee on top of interest adjustment, just ask them what happen if you withdraw early, they won't tell you, the excuse is you don't have existing TD account. That's why I won't put my money in there, not worthed.

Rest assured that Banks never lose

This rate is just indicative of whats coming up soon

So AMP is just front running the RBA to lock in as much cash as possible at what will be considered a very low Interest rate in 12 to 18 months time

But all those fees u get charged when ur dead…

I know im already going to have a hard time dying let alone getting charged fees😳

interest rates are only going one way,

There'll be a hole in your forehead in a minute, I swear to god..

Are you getting paid for spewing this crap?

Or if you're serious: how about a bet. I say RBA cash rate will still be well below 3% by year's end. How much are you willing to bet against that?

definitely a boomer

All your party political posts are more likely to work against you rather than for you Mr Staffer.

Thankfully only 2 days to go.

I normally don't Neg, but this is pollution.

As a person who just paid off his mortgage about 2 months ago and is now saving, I, for one, welcome our new high interest rate overlords.

Tbh as someone who hasn't bought a house yet I still don't think it's a bad idea. That's said it won't lower house prices much if super is used for deposits or the government underwrites loans.

Yep, government is terrified of a housing crash but that's exactly what's needed. They pay lip service to "housing affordability", but the only way to actually achieve that is by bringing the damn prices down.

Let it burn. Chase some of the speculators out of the market and make it more affordable for people who just want a home to live in.

That u Clive?

Ah, so I guess we have to vote in Fatty Mc (profanity) to get interest rates capped at 3%

Squawk!

I still stand by my claims

Good for you. Easy to make claims when you parrot a political party though, really. It's just a copy and paste.

another LNP fanboi with their investment (profanity) properties.

Negged

Negged.

@RexHavoc: Everyone needs to pay tax. I hate those with investment properties that don't pay tax thanks to neg gearing rort. Hope they all get burned!!

@[Deactivated]: I agree. If it means a better education and health system, they can go nuts with taxes. It's better than watching them waste away. Quite happy to pay more for it.

@[Deactivated]: Votes are still being counted. Until every last vote is counted, Scott Morrison is still my prime minister.

I actually would like to see a recount on some seats also.

I wouldn't lock in a 5 year TD right now, given we are the start of the interest rate hike cycle. Lock in for no more than 6 months, so you get the benefits of the rate rises which have already been flagged by the RBA.

Yes, 5 year rates will almost certainly be higher in 2 years time than they are now.

But by then you'll have missed out on a lot of interest if you leave your money lying around at 1% or a 2 year TD for 3% in the meantime.

This is a clear case of "A sparrow in the hand is better than the pigeon on the roof".

well, to beat a 4.15%pa for 5 yrs, which starts paying/compounding from today, the rate needs to be a lot more than 4.15% in the latter years. ie

1.0415^5 = (1+r1) * (1+r2) * … * (1+r5) , where rn is the 1yr rate of the nth yr

r1 is still low at the moment, around 2% say, so the latter r's have to be much higher to win with the rolling strategy. The flaw though is that interest is paid out monthly so you cannot always reinvest it back into the 4.15%.

5 years too long

if locked with 5 year term but want to leave earlier what's the penalty?

They will deduct from 0.1% to 0.5% p.a depending on when you are withdrawing. Portion of term completed 90% or more : 0.1%. Less than 25%: 0.5%

Is it linear between 25% and 90%? As in 57.5% of the term gets you around 0.3% penalty

Good luck trying to open an acct. I've been waiting a week and still not done, and I'm an existing customer..

It costing me $ as my $ are earning nothing while waiting.

Mine took 2 days

Thanks for that warning. So they are not great on service…

They would probably doing some checking, unsure why the account is not able to be opened straight away. Possibly only one person doing the manual checking, but who knows

Told me 3 days max to opn acct at first. I've called twice, there are no problems there just "busy". Then told they will escalate it and let me know in 1 to 2 days - so given its a weekend coming that means 3 days - at least…

I went ahead anyway, with the expectation that things move slowly.

35 minutes after submitting the form the account was confirmed as opened. New customer, never been with AMP before.

Now I've got the problem that the cash is still on the way from ING to my transaction account, I hope AMP's direct debit doesn't fail. Oops.

I got an "We've set up your term deposit" email within the hour.

$20,000 gets you .5% higher interest rate.

I’m just not sure it’s worth it.

lol mates, within 4 years, you're gonna wish you'd run on the banks to withraw your savings, not locking em away with these criminals for a measly few % pa.

Still better off in an offset against home loan (if you have one) as you get taxed on interest earnings.

Wrong - it depends on your interest rate and income tax rate.

5 years. Given the state of the current economy and interest rate movements (thanks scotty from marketing), it is a higher risk proposition than offsetting on your home loan.

That’s even before considering tax implications.

Even the 5 month Term is pretty good.

Yep 2.15% and then see what rates are like in 5 months.

IF one has a home loan and is on a high tax bracket, it would be cheaper to just keep the money in the offset account, wouldn't it?

Yes and no. Depends if it is an investment loan or not as you would be losing out on the same tax deduction if investment, but if rate is lower than this term could be better

If ppor then you might be better off leaving it against loan after 30% tax on term dep

what happened to 8 months rate?

OZB Forum: Why aren't banks increasing deposit rates!

Also OZB Forum: Oh they are, but I want no restrictions! Waaaahhhhh

And Also OZB Forum: I want to be rich NOW, I want FREE money NOW!!! gimme gimme gimme.

wow. Guaranteed to lose money. That's a losing deal. Put your money into second hand cars

Put your money into second hand cars

Also if you put it into super market brand facial tissues before it went from $1 to $1.30 you'd be 30% up. If you put it into the stock market you're about 12% - 25% down.

Are these some of the highest interest rates out there?

Do you work for chemist warehouse marketing team?

With high inflation it is better to have productive debt at least that is the theory.

For example you owe the bank $300k at 2.5%. Inflation usually means prices rise on everything including income producing assets and also wages. If your wages go up with inflation 5% the $300k doesn't inflate 5% it stays the same (or goes down as you pay it). That is the theory but as cypto has demonstrated, so called inflation hedges aren't inflation hedges.

If it's end of term interest payout, then would you get any interest at all upon early closure?

Don’t want this to get lost, but they don’t just shave off 0.5% of the interest rate if you withdraw early. Read the Ts and Cs, there’s a calculation they do based on numerous factors, including the current rate and the days invested.

Isn't this shaving the 0.5% if the interest rate, and then pro-rataing the term based on the number of days you have actually invested? (i.e. they wont give you a whole interest of year if you are cashing out half way through)…

It looks right, and i cant see any either fees/penalties??

They can decide to apply a different rate to the 0.5%. Nobody has figured it out yet as they don’t have an existing TD

2 years is the sweet spot at 3.65%. Almost guaranteed profit over keeping in a savings account for that time.

Just opened with Macquarie Bank Term Deposit 2 year term, 3.25% interest paid Monthly

Just curious, why don't you go with AMP for 3.65%?

Just wanted monthly interest payment.

8 months TD interest is 0.90! Really or a typo?

I'd rather cut my face off, fry it and eat it than deal with AMP again.

Miserable company, getting my super out of them was an utter nightmare and to my knowledge, they broke the law / rules on the difficulty getting it out.

Scummy business, avoid at all costs.

My dad's lawyer said the same thing about them. He said getting money out of AMP from life insurance policies really requires a lawyer otherwise they will delay and obfuscate indefinitely. Terrible! That said, I've got money parked in AMP Bank now in their 1.35% savings accounts and haven't had trouble getting money out of it so far.

Most savings accounts are Gov guarantee, can't remember how much maybe up to $250k. So its relatively safe.

- 1

- 2

Nah. It ain’t great. If we get 4 x 0.25 RBA increases by years end you’d see better short term pricing which would give you more flexibility to get your money back and redeploy if an opportunity arose.