A rise after 11 years. Interesting times. How will OzBargainers be affected by this? Keen to hear your thoughts.

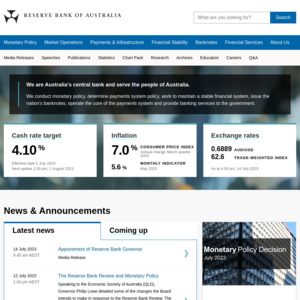

RBA Raises Interest Rates by 25 Basis Points

Related Stores

Comments

Economist here. This is a simplistic way of looking at it, sure the sticker will be less, but your borrowing capacity will be lower due to the higher rates, and your repayments will be higher. Yes, your deposit will be lower, but the opportunity cost of using your deposit will be higher due to the higher rates. In other words, you are no better off.

Monetary policy (as a nominal instrument) never makes anyone better off, it is just to influence (at a macro level) people's consumption / savings / investment decision. With higher rates, people save more and consume / invest less, hence putting downward pressure on prices. But it does not mean that those who still want to consume are better off, because the opportunity cost of consuming (in nominal terms) is now higher, and the amount you are paying (in real terms) is still the same. If you want to understand why this is the case, consider the extreme example - if interest rates were 50%, nobody would want to buy anything and prices will plummet, but that's not good for you, because if you purchase things now, you're losing out on a huge opportunity cost (i.e. you might be only spending $1, but the $1 is worth a lot more now since you can earn a lot more interest on it)…etc.

The issue with houses has always been that there are too many people and too few "desirable" houses. Nothing can change that. Prices falling is just due to the increased opportunity cost of purchasing. If the opportunity cost is increasing for others, it will increase for you too. Comparatively, you are still in the same position you were in before. In other words, if there are 5 houses, and 10 people wanting to buy, if you are the 6th richest guy of the 10, regardless of what nominal changes occur, it doesn't change anything for you as your "real wealth" has stayed the same.

By no means a complete analysis BTW, you could make arguments that higher rates places pressure on investors, who are more likely to sell…etc., which is likely true, but on the face of it, lower prices because of higher rates is not a good thing.

Think of the extreme, if rates were 30% and house prices were, on average, $100k, does that make it good for you? Not really, because the people who don't have the deposit won't be able to afford the loan, and those who do have the deposit have a very high opportunity cost, since you can put your money in the bank and earn more interest.

An interesting perspective, thanks for that. Not too concerned about deposit or monthly payments though, even if those need to increase, was more hoping that $1.4m properties stop selling for $1.8-1.9m due to sheer competitive demand.

Basically, wishful thinking that increased interest rates would impact demand at auction. Unlikely for sure.

was more hoping that $1.4m properties stop selling for $1.8-1.9m due to sheer competitive demand

Why? You might be paying $1.4m on the sticker, but in that world, $1.4m of dollars is worth $1.8m of dollars in our world, so your financial situation is the same.

Perhaps the question you need to answer is why you can't afford the $1.8m house in the current market. If it is a limitation of your borrowing capacity, then you will likely not be able to afford the lower price with higher rates as you will still have the same restrictions. If it is that you do not have the deposit, then with the lower price, your deposit is now worth more, so it makes the purchase worse (rate of return on your property is lower, essentially).

@p1 ama: It's not a financial concern, it's more a value perspective.

Paying $1.9m for what should be $1.4m house doesn't sit right. Particularly as many of those overbidding heavily on properties are doing so with cash from abroad via proxy bidders, allegedly, according to REA.

However, I completely understand the "it's worth what someone's willing to pay for it" perspective. I know. Still hopeful.

@Hybroid: As you say, if someone is paying $1.9m then the market has determined it’s worth $1.9m, not $1.4m

Paying $1.9m for what should be $1.4m house doesn't sit right.

Not trying to trivialise your concern, but I think you are not understanding my point that when rates change, what $1 is worth will change.

Unless the physical demand has decreased (which would be if people moved overseas, say) then the house is still worth the same before and after the rate hike. The fact that it has (nominally) fallen in value reflects the higher worth of $1, not a lower value of the house.

You're confusing nominal and real prices.

@p1 ama: Love your analysis. Was a really interesting read.

I think some of these things go above the head of people who don't understand these concepts. Opportunity cost applies to everything but sometimes people can easily get lost in the absolute dollar value of something. There are a lot of things that effect the economy that even economists cannot predict but for most people as long as they see prices going down they think it's a good thing.

what $1 is worth will change

I understand that point - raise rates to make people value their money more than the products (i.e. houses) they're using it to buy. People keep their money, since they value it more. Prices decrease due to decreased demand.

The problem I have is that I don't see it fixing the real issue. Inflation currently, in my uneconomist opinion, is due to decreased supply due to production and supply chain issues from COVID and the war in Ukraine. Oil supply is diminished which has seen prices go up, increasing the cost of freight, which increases the cost of everything. I'm not buying petrol or groceries because I have cash to throw around: I need to get to work, and I need to eat. I don't see increasing rates decreasing demand for these products, and increasing rates will see increased rents and repayments, so people will just be spending even more money, money that they potentially don't have. People will be deciding whether they want a roof over their heads, a meal on the table, or a job.

Yeah, prices for unessential items will probably fall. Great, I can go pickup a large flat-screen television for less. Maybe the kids can eat the capacitors in it…

As per usual, I see the rate increases (in the short term) hurting the poor and benefiting the rich. Might be short-sighted of me, might not.

Feel free to pick this to pieces - I am curious on your opinion with respect to how increased rates will impact cost-of-living items like petrol and groceries, since I don't believe it will have the desired effect.

@Hybroid: “ Particularly as many of those overbidding heavily on properties are doing so with cash from abroad via proxy bidders, allegedly, according to REA.” - kind of sounds like the xenophobic lingo from three years ago.

Foreign purchase of Aussie homes has dried up significantly, due in part to stringent capital measures and strained relations with China causing Chinese buyers to cool on Aussie properties.

I find it highly unlikely a $1.4m house is being sold at $1.9m due to proxy bidders. You’re either grossly exaggerating or you don’t have a good gauge at the market (you do realise the quoted range by agents isn’t reflective of true value don’t you)

Where is this REA data you’re referring to?

@Optimusprimetime: I think the post COVID increase in prices dispelled alot of that. I was in the market at the start of 2020 looking for a bargain only to find like minded folks at the auctions… no proxy bidders, just a lot of rich people buying property.

@Hybroid: If you are a cash buyer this makes sense. If borrowing (for all the reasons discussed above), not so much.

@Hybroid: No one pays $1.9m for what should be $1.4m. You might hear this on the news as it makes for good reading and headlines and clicks.

In reality, that $1.4m was underquoted as perhaps that house had significant feature benefits over previous sales of houses of the same size/land.

People with lots of money don't overbid. If they made the money, they understand the value of money and they're bidding on the value of the property. REA reporting on properties paid with cash from abroad is a very broad statement and applies in many different situations, but if you're talking about cash from abroad on $3m+ properties that is another market altogether. Big cashed up buyers from overseas don't bother with sub $2m properties.

@p1 ama: For me personally the problem is that house prices are growing way quicker than what I can even manage to save.

@p1 ama: This assumes people are rational but they're not, rate rise just make the game of chicken more interesting, people will speculate what will happen since there's potential momentum for further increase and people price in uncertainty differently

@p1 ama: The risk Hybroid would have to endure is far lower if he buys it in the state of the world where rates have already gone up and the price has fallen to 1.4m - so they are actually better off, even if his bank payments are essentially the same. Also if they have a large deposit they are better off as it would be a competitive advantage against other bidders (especially if rates are the biggest factor in pricing) and their deposit would effectively be earning a higher return invested in the house than if they had bought before the hike!

So, better off!

Another thing to consider is that if property prices start to fold there is also a 'hold' mentality if I can afford to 'hold', which will also limit market supply and stop prices from dropping too much.

Another thing to consider is that if property prices start to fold there is also a 'hold' mentality if I can afford to 'hold', which will also limit market supply and stop prices from dropping too much.

So much this. And you really don't want to put the country/economy in a situation where people are unable to hold (especially considering the least well off are the first affected).

When prices dipped in my suburb in 2017-19 on the surface it sounded bad but reviewing what was for sale showed that nearly all quality homes were being held while only compromised homes (developer knockdowns and tiny 2 bedders that families had outgrown) were actually for sale. Everyone who had a house that was suitable for them just held onto it and refused to sell in a down market (which ironically made the market appear to drop further).

Everyone who had a house that was suitable for them just held onto it

Those who bought with 20% deposit isn't going to sell when prices go down 15% (unless they have to) because you can't repurchase even if all houses went down 15% because your equity is wiped out.

With price of building houses going up the housing market is going to be jammed up. People can't sell or build (not worthwhile building) and builders will continue to go bust (less people building but also higher cost in fixed priced contracts basically sending them bankrupt).

Going to be interesting times.

@stirlo: That's what I saw at the start of COVID. As soon as a quality home come on, it was like everyone in the state logged on to the online auction, the highest we saw was 65 registered bidders… the house went about 450K above reserve which was about 200K above pre COVID prices for similar properties in the same area…

wishful thinking that increased interest rates would impact demand at auction. Unlikely for sure.

Not wishful thinking at all. Higher interest rates will have an effect on both demand and prices achieved at auctions. I'll bet an Eneloop on it.

@ p1 ama - This is the most sensible post I have ever read on Ozbargin. Thank you.

But at your extreme one of your base needs (vs opportunity to invest) gets met.

Plus there isn't as much space below you to fall/wipe out a hard earned deposit.

Think of the extreme, if rates were 30% and house prices were, on average, $100k, does that make it good for you?

Not me personally, but for all of the people who just want to live their lives in their own home and can't afford $1M+ houses, yes. Those people would only have a mortgage payment of $525 a week which would pay the house off in 10 years for a total cost of $271k.

A $1M house would have a weekly mortgage repayment of $853 and would take 30 years to repay at a total cost of $1.33M. Housing is not a consumer item or investment vehicle, or, it shouldn't be.

Housing is not a consumer item or investment vehicle, or, it shouldn't be.

Except that, for better or worse, it is.

@johnno07: From a macro prespective is sucks capital into a (mostly) non-productive asset; market failure.

@Elfarol: Sorry - yes I agree with this. Rather than "it is" I meant that "it is treated as such". Housing has value as a home, but I would never buy it as an investment.

Not me personally, but for all of the people who just want to live their lives in their own home and can't afford $1M+ houses, yes. Those people would only have a mortgage payment of $525 a week which would pay the house off in 10 years for a total cost of $271k.

That makes no sense. Typical mistake confusing real and nominal prices. You're assuming that $1 in our world and $1 in that world are worth the same. They are not. In our world, the opportunity cost of $1 is around like 1-2c each year. In that world, the opportunity cost is 30c each year.

Let's think about this logically (not emotionally). Let's forget about loans to keep it simple. I'll ask the question another way. Imagine that house prices do not go up and are flat. What is cheaper, a $1m house in our world, or a $100k house in that fictional world?

Actually try and answer this.

Answer: the $100k house in that world, as the opportunity cost per year is $30k, whereas with the $1m house in our world, even with rates of 2%, the opportunity cost is only $20k per year.

Be careful of your numbers because they are predicated on $1 always being of the same value, which is not true when we're discussing rate changes.

If this is confusing, imagine you have two machines. The first machine can earn you $30k per year and the second machine can earn you $2k. Let's say you need to trade 20 of the second machines for a house, or trade 2 of the first machine. Are you necessarily better off in the second situation? Sure you're only trading 2 machines instead of 20, sounds good on paper, but that's forgetting what the machines can do for you.

@p1 ama: I don't know shit about economics but your argument seems, still, to be centered around a house as an investment.

To buy a $1M house, you'd want to have $200,000 dollars deposit at least, to save yourself on insurance/interest a bit and to reduce your exposure to rates/price changes. After you buy, you are still carrying a significant financial risk.

In your fictional world, you need $100,000 dollars to buy outright, negating the need for any interest payments and financial risk. You own the roof over your head and have housing security for the rest of your life (save for financial/environmental disasters). Sure, it has a high 'opportunity cost', but for most people it'd be worth it.

To save $100,000 in your fictional world, at say, 20% interest paying monthly and putting away $500 a fortnight, it would take 5 years. You can own a roof over your head, in five years. In our world, at 0.5% interest, it'd take you 15 years just to save the deposit. After 15 years and one day, you happily stroll down to an auction just to find out that house prices have increased 300% in that time (@ 8% per year for 15 yrs), and you've got another $400,000 to save.

Look, you'll probably tell me that interest rates that high cause all kinds of other issues which might effect my life negatively, I don't know. But purely from a housing point of view it seems preferable.

I don't know shit about economics but your argument seems, still, to be centered around a house as an investment.

You should learn, it helps you understand the world. You would be surprised at how useful it is.

The point around a house as an investment, that is because it is what it is. Don't delude yourself. If property returned 0.5% p.a. instead of ~9% p.a. in the long term, nobody would want to own a house and everyone would want to rent.

You are making the same mistake that everyone else who is arguing back and forth about this is. You are assuming that $1 is always worth the same. It is not. You cannot, in the same breath, argue that increasing interest rates will put deflationary pressure on prices, and turn around and not acknowledge that the deflationary pressure is literally because $1 is now worth more than it otherwise would have been without the rate increase.

Therefore, in real (not nominal) terms, you are still paying the same amount.

In your fictional world, you need $100,000 dollars to buy outright, negating the need for any interest payments and financial risk. You own the roof over your head and have housing security for the rest of your life (save for financial/environmental disasters). Sure, it has a high 'opportunity cost', but for most people it'd be worth it.

Your last sentence is contradictory. "Opportunity cost" is the definition of "worth it". If something is "worth it", it is because it has low opportunity cost and vice versa. Again, you are failing to understand the point that $100K in that world is literally worth a lot more than it is in our timeline.

If this continues to be hard to understand, let me ask another analogy. Let's say that tomorrow, there is a new AUD, and 10 of our current AUD will convert to 1 new AUD. Your $1M house is now $100K house, has it gotten any cheaper?

This is exactly what interest rate changes are doing, they are changing the nominal value of assets by changing the value of $1 (exactly as in the above analogy). I'm probably not going to spend any more time arguing this point, but I do want to make it clear that higher rates (from the perspective of housing affordability) is not necessarily a good thing.

@p1 ama: Ok, I guess my issue with what you're saying is that it doesn't seem to reconcile with the past. Let's got back to 1989, when the official interest rate was almost 20%, the median capital city house price was less than $100,000 dollars, and house price growth was stagnant. Now, the official rate is 0.35%, and the median capital city house is around $1,000,000.

The average weekly full time salary in 1989 was $492, versus $1813 now. $1 then does not equal $10 now, in fact the RBTA say that it $1 then would be worth approximately $2.27 now (and I assume that's actually factoring in housing costs, so with respect to housing might even be less).

Are you saying it was just as hard (or harder) to buy a house in 1989 as it is now?

@p1 ama: "The point around a house as an investment, that is because it is what it is. Don't delude yourself. If property returned 0.5% p.a. instead of ~9% p.a. in the long term, nobody would want to own a house and everyone would want to rent."

Not quite true. Perhaps valid for economists and people with financial background, but I know personally tons of people who'd choose 0.5% p.a. in the house rather than, say, 9% on the stock market - for the simple reason, stability, lower risk, investment in the instrument (house) that they know and no fears to stock crashes/etc. that don't apply to houses. So in my view, that statement is not true for majority of population.

Another aspect that you don't take in your consideration is money availability due to irresponsible lending practices. Liars loans (apparently up to 30% of all loans in Australia) and other suspicious practices - I know of people (100% confirmed news from a real estate agent) who after mortgage are left with less than $1k per month to survive. That's unethical lending at its best, widely supported everywhere, just to drive the market higher - just to support brokers/agents/banks profits. Don't believe me? First news of 0.25% rates hike and major drama on main news around debt serviceability.

If property returned 0.5% p.a. instead of ~9% p.a. in the long term, nobody would want to own a house and everyone would want to rent.>

I will still buy as I want a place of my own. We can't say a house is not an investment but it is not just an investment.

For some people, a house is like a car. Car value depreciates year by year but people still buy it instead of taking a cab.

@p1 ama: "The point around a house as an investment, that is because it is what it is. Don't delude yourself. If property returned 0.5% p.a. instead of ~9% p.a. in the long term, nobody would want to own a house and everyone would want to rent."

Disagree with this. It only applies to people foolish enough to assume their PPoR increasing grows their "wealth". It doesn't do that at all: council rates go up etc, in fact almost all costs of living are subject to rent costs (a derivative of property price), so day to day expenses rise, and that's before even considering that the house has only moved with the rest of the market. Want to sell and move? Much higher stamp duty!

Housing is a consumption item. And if it wasn't viewed so much as an investment, people would be buying it for security and stability and without being forced to up and move at some landlord whim.

In fact to turn your argument on it's head, everything you explained currently suggests it already makes NO sense to buy a house to live in!

If rates were at 30% you would be earning crazy money from depositing money in the bank. People would be purchasing houses outright.

If rates were at 30% you would be earning crazy money from depositing money in the bank. People would be purchasing houses outright.

You're still missing the point. Why would anyone purchase an asset returning ~9% p.a. when they are earning 30% p.a. on their capital?

@p1 ama: Because people don't make decisions solely on financial outcomes, and value is derived in other ways, not just return. Your statements are fine for modelling or on a theoretical basis, and certainly, there is a correlation with what happens, but real world outcomes don't occur linearly with financial models, and markets and information aren't perfect; further there are time lags, because again, markets aren't perfect. The returns may be skewed at that point in time, but what about over longer timeframes?

For example, prices go up, therefore wages should increase accordingly, but it takes time for this to occur, if at all, and certainly not at the same rate. There are also other market forces/costs, including taxes, and non financial forces which impede efficient transactions and perfect outcomes

@RMBC: So what are you trying to say exactly? My point is just that monetary policy are a hugely technical topic that people spend years and years learning about and become experts in. I'm not saying that I am an expert, but I have spent all of my adult life in and around the field.

As much as I enjoy talking to non-economists about monetary policy (because I think it's useful for the general public to have some understanding on the topic), I've never understood why everyone feels entitled to have an "opinion" on topics that are well-studied and have a large body of knowledge. For example, I wouldn't go around opining on roads and bridges because I'm not an engineer and I know nothing about the field.

I've never understood why everyone feels entitled to have an "opinion" on topics that are well-studied and have a large body of knowledge

And yet every economist (and road and bridge engineer) can offer a different opinion on the subject of their expertise. Maybe tone down the arrogance?

@BigBirdy: Exactly, one economist predicts an inflation rate of 2% while another 5%. Let's throw some darts?

At least in engineering, there are first principles that can be relied upon. How an economy works is hugely complex.. but an economist will use theoretical examples out of a textbook.

Exactly, one economist predicts an inflation rate of 2% while another 5%. Let's throw some darts?

You make it sound like numbers are just plucked out of thin air. Another example - just because the weather forecast is not always right does not mean that there is no science to weather forecasting and that you can just "throw some darts" to figure out what the weather is like tomorrow.

At least in engineering, there are first principles that can be relied upon.

There are in economics as well.

How an economy works is hugely complex..

So is how a bridge works, and how a computer works, and how diseases work…etc. The fact that it is complex is why you need to study it, to understand it, to build models, to analyse it…etc. If it was simple, people would not spend time studying it.

but an economist will use theoretical examples out of a textbook.

Yes, because simple examples are where one builds understanding of a complex problem.

@p1 ama: when was the last time you saw a disclaimer "performance of past bridges does not guarantee future performance of new bridges" ?

@blues86: It's complex, so they use theory to simplify. Simple solutions to complex problems tend to do better than complex solutions for complex problems.

Also, academic economists agree a lot more than you think. Predicting the future remains a hard and complex problem with more likelihood of error. Media never reports on error bounds of modelling.

And yet every economist (and road and bridge engineer) can offer a different opinion on the subject of their expertise.

On their subject of expertise, yes. The issue is when people confidently opine on things that they know nothing about, then when proceeded to be called out on it, hide behind "it's really complex, nobody really knows how it works".

Maybe tone down the arrogance?

I think it's far more arrogant to confidently opine on things people know nothing about, but maybe that's just me. FWIW, I would never go around purporting to have an opinion on things I have no expertise on.

I would never go around purporting to have an opinion on things I have no expertise on

Wish more people would take this approach

@BigBirdy: I think his statements are fair, people generally don't even have a basic understanding of a fairly complex system such as economic drivers so it baffles me when there conveying there opinion as some sort of fact.

Interesting but my view is current deposit will go further if price drops. Our salaries went up significantly this year which kinda balances out the borrowing power reduction of the higher rate.

But if the average person can now borrow less it means they can't spend as much, thus prices should fall.

In nominal terms, yes, but remember you can't spend as much either.

Everyone is affected in the same way and you're in the same situation you were before. That's the point.

What if tax rates were at 80%?

Your arguments are rational as an economist but doesn’t reflect the behaviours of humans i.e. people get overconfident and things are going well and fear when things aren’t going well.

You argue monetary policy never makes anyone better off. This is so far from the truth. The loose monetary policy we have experienced has increased inequality. Why? Because the guy with assets is worth more now and is likely to be in a better position to use that equity to invest. What about the average joe who has an ordinary income? I’m making an assumption here but in my view his/her investment portfolio is likely to be very unsophisticated and likely weighted towards cash. So he/her is in a worst position.

Monetary policy is not a blunt tool, yes it can become less effective but it does impact investment decisions and valuation of assets. Why do you think tech stocks have been impacted the most in the recent sell off? Concerns about increasing interest rates. Lowering interest rates gives buyers and investors confidence and it can create exuberance. Just look at the performance of the property market over the last 18 months!! FOMO?

So if someone has been sitting on the sidelines, of course they are better off in an environment where rates are increasing. It will take the exuberance of the market.

Don’t trust an economist to invest your money ;) Sorry couldn’t help myself

You make an assumption that they need to borrow to buy

I see it differently. Having interest rates set at artificially low levels was always going to cause prices to rise to unsustainable values. The sooner we get rates back to a "neutral" setting the better IMHO.

If you take a hypothetical situation where two identical homes are side by side and one sells today for $1m and the other remains unsold until late next year for say 14% less, $860k, which home owner is better off? From a flnancial perspective the answer is obvious. Buying now saddles people with higher debt and a higher mortgage repayment bill as interest rates rise and this will be on an asset that in all probability will decrease in value.

too many people and too few "desirable" houses. Nothing can change that

We could reduce immigration and rezone more land for higher density properties. That would change things rather quickly.

This analysis is too simple.

Rising interest rates help home buyers in a number of ways:

They take FOMO out of the market. People rush to buy houses when they see prices going up at a rapid pace. People can take their time and buy only when they really need to if prices are not skyrocketing. This subdues demand. Buyers are no longer competing with as many people.

They subdue demand in the investment property space. Investment properties, especially for houses as opposed to apartments, are a capital gains game. If capital gains disappear, there is little reason to hold on to them, so investors sell and don't buy more, especially if they can earn acceptable yield on cash, which rising interest rates will help. This frees up housing stock for buyers.

They take FOMO out of the market. People rush to buy houses when they see prices going up at a rapid pace. People can take their time and buy only when they really need to if prices are not skyrocketing. This subdues demand. Buyers are no longer competing with as many people.

This is a pretty contrived argument IMO. The fact that people are "taking their time" doesn't seem to make much sense to me. You're still competing with the same amount of people, just allocated differently over time.

They subdue demand in the investment property space. Investment properties, especially for houses as opposed to apartments, are a capital gains game. If capital gains disappear, there is little reason to hold on to them, so investors sell and don't buy more, especially if they can earn acceptable yield on cash, which rising interest rates will help. This frees up housing stock for buyers.

Yes, this is true and I said as much in my original post. However, my issue with this argument is also contrived because the so-called "freed up housing stock" was once occupied by renters. The renters will now either have to rent from a smaller pool (pushing up rents), or they will buy a house (pushing up prices).

This is a pretty contrived argument IMO. The fact that people are "taking their time" doesn't seem to make much sense to me. You're still competing with the same amount of people, just allocated differently over time.

Did you not learn about the concept of demand being pulled forward at university? This is economics 101 — well, maybe economics 201.

Rapidly rising prices is one trigger for bringing forward demand. Indeed, I suggest you listen to any property podcast, talk to any first home buyer or read pretty much any newspaper. The fear of being locked out of the property market, leading buyers to bring forward their property purchases, was ubiquitous last year.

It also makes intuitive sense. Who is your typical first home buyer? A young couple that are renting. There is often flexibility as to when they can buy. They can stretch (5% deposit, ask the parents to go guarantor, etc) and buy tomorrow or wait until next year while they build a bigger deposit. In a rapidly rising market, the former becomes a lot more attractive than the latter. Indeed, it feeds on itself. As more opt for the former, the latter becomes less and less attractive. FOMO.

Yes, this is true and I said as much in my original post. However, my issue with this argument is also contrived because the so-called "freed up housing stock" was once occupied by renters. The renters will now either have to rent from a smaller pool (pushing up rents), or they will buy a house (pushing up prices).

This ignores the fact that they are not substitutes for each other — they are poorly correlated classes of housing stock. It is very common for young couples to rent an apartment for convenience/cost/etc and then buy a house for their 'forever' home. So more houses coming on to the market helps home buyers without necessarily harming renters. In a poor capital growth environment, investors are incentivised to chase yield, which is found in apartments, not houses. So actually it will make the situation better for renters. There will be increased demand for apartments from investors, leading to more construction/completion and more apartments on the rental market.

Did you not learn about the concept of demand being pulled forward at university? This is economics 101 — well, maybe economics 201.

You didn't read my point, which is that you are still competing with the same people. If the demand is pulled forward and you know that, then it is in your interest to wait for the tide to pass.

It also makes intuitive sense. Who is your typical first home buyer? A young couple that are renting. There is often flexibility as to when they can buy. They can stretch (5% deposit, ask the parents to go guarantor, etc) and buy tomorrow or wait until next year while they build a bigger deposit. In a rapidly rising market, the former becomes a lot more attractive than the latter. Indeed, it feeds on itself. As more opt for the former, the latter becomes less and less attractive. FOMO.

Yes, of course. But you are speaking from both sides of your mouth here. Either:

1) Everyone is crazy and overpaying, in which case, the right solution is for you to wait until the tide passes

or

2) Prices rapidly rising are due to structural forces pushing up demand (or supressing supply), in which case, you should most definitely get in before prices go up even more

Both can't be right and the solutions for each are different. You are basically saying that the right explanation is (1) when it suits your argument, and (2) when it suits your argument.

This ignores the fact that they are not substitutes for each other — they are poorly correlated classes of housing stock. It is very common for young couples to rent an apartment for convenience/cost/etc and then buy a house for their 'forever' home. So more houses coming on to the market helps home buyers without necessarily harming renters.

This is just untrue - percentages of renters in many suburbs are very high. Not all renters are uni students in apartments. To be honest, what you're describing, the idea of a "forever home" is probably what harms buyers the most. The pressure to purchase the perfect home right from the get go rather than looking at alternatives that might be more affordable.

In a poor capital growth environment, investors are incentivised to chase yield, which is found in apartments, not houses. So actually it will make the situation better for renters. There will be increased demand for apartments from investors, leading to more construction/completion and more apartments on the rental market.

It will lead to higher apartment prices, with some more construction, but that will be more difficult since financing costs are higher. Hard to say what the net result will be, but I agree that investors will be incentivised to invest in apartments. It doesn't really change my original point though, which is that there will be less houses for rent (if we go with your assumption that apartments are a different type of housing stock).

You didn't read my point, which is that you are still competing with the same people.

@trapper adequately addressed this point in their reply. You are not competing with the same people in a panic buying scenario — you are competing with more people because everyone decides they need to buy right now. That is the very idea of demand being pulled forward. In a normal market, people decide to buy at a fairly orderly pace. In a rapidly rising market, everyone rushes to buy at once because they think it is their last opportunity to buy before there are no more affordable houses.

But you are speaking from both sides of your mouth here.

No I am not. My response is the same as above. It is much easier to buy a house (or toilet paper) when panic buying is not occurring. Higher interest rates will stop the panic buying.

percentages of renters in many suburbs are very high. Not all renters are uni students in apartments.

There are plenty of apartments in suburbs in the major capitals. Where did I say that all renters are uni students? Far from it. You are boxing at shadows here.

It doesn't really change my original point though, which is that there will be less houses for rent (if we go with your assumption that apartments are a different type of housing stock).

But with fewer investors competing with first home buyers to buy those homes.

This is a pretty contrived argument IMO. The fact that people are "taking their time" doesn't seem to make much sense to me. You're still competing with the same amount of people, just allocated differently over time.

I think you missed his point here.

People are paying far more than they think a house is worth because they think it will be even more overpriced tomorrow.

It's almost like a panic buying situation. There was no actual shortage of toilet paper.

If interest rate rises by 1%, and house prices drops 10%. My deposit money is worth 1% more, but the thing I want to buy is 10% less. Isn't that still better for me?

You talk about higher payment, but imagine you bought at the peak price, with the lowest interest rate? Isn't your payment higher too?TBH I don't want to be the guy who bought at the top with the lowest interest rate. I think if rate rise and house prices drop, my situation should be better that him.

You also have to pay higher interest which means you can borrow less. So you'll end up being able to afford the same type of property you could before the rate rise even if it nominally is cheaper.

Even if you have saved enough to pay for the whole thing in cash, you are losing the opportunity to make more money in interest by leaving your cash in the bank.

So you'll end up being able to afford the same type of property you could before the rate rise even if it nominally is cheaper.

Yep, but in that case my repayment will be less than the guy who bought at peak, and now has the same interest rate with me, right?

Also an economist here. It's just not true that "monetary policy never makes anyone better off" - for a start, changes in it create large and arbitrary shifts in real incomes and wealth (no-one believes in full rational expectations and money superneutrality these days).

But poster is correct that it is house AFFORDABILITY rather than PRICE alone that matters for people's wellbeing and that is what we should have been focusing on; they are not the same thing at all. Because of the uncertainty and expectations of future interest rate rises, tightening money tends to reduce the price but can worsen the affordability of housing. And to the extent it makes other investment classes more attractive (largely because expected capital gains disappear) it tends to reduce the number of new houses being built, which worsens the problem. It can lead to a rental problem as well as a purchasing problem.

Affordability and price are inextricably linked. Given where we are in the cycle, price matters more. All asset classes have benefitted from falling interest rates. For property, leverage has provided a significant boost to returns i.e. ROE.

Yes, higher interest rates can reduce investment and the number of houses being built but housing starts and completions over the last few years have held up reasonably well, particularly given the impact of COVID. Remember, it's cyclical and the market will find a balance. But as we stand TODAY, price is what matters. The exuberance coming out of the market (hopefully) will help a lot of potential buyers.

it tends to reduce the number of new houses being built

Well we have whole suburbs of temporary accommodation being thrown up where no one would ever want to permanently live. It may be a good thing to reduce the amount of these junk 'investment property' type houses and start building actual homes instead.

There's plenty of homes, it's just not all are being lived in. Then there are the full time BnB types.

Legislation to change this can't come soon enough.

What legislation? More money or abolishing negative gearing? Those affect the prices, yes but are not about targeting empty homes.

A vacancy tax will strike at the heart of speculators hoarding empty properties. Why not. Those mom n pop can claim PPOR on two properties aren't affected. Those renting out properties aren't affected. Those people that hoard empty properties will be furious though and will sell or rent it out.

@orangetrain: While I reckon a vacancy tax can't hurt, you are kidding yourself if you think it will make much difference. Because there are far too few empty properties being hoarded to make that difference. Buying a property and failing to either rent it out or live in it yourself is the absolute epitome of dead money. Only financial idiots or obscenely rich people who have more money than they know what to do with (eg a few parents of Chinese students) do it, and their numbers are small.

As is often pointed out, successful speculation stabilises market prices because to speculate successfully you have to buy when prices are low (ie push the maket up) and sell when they're high (ie push it down). For the same reason unsuccessful speculation destabilises. It remains to be seen if all those little owner-investors will be successful speculators or not.

Because there are far too few empty properties being hoarded to make that difference.

3-10% of dwellings are empty (upper bound is a very naïve assessment based on census data, lower bound is particularly conservative). In either case I'd certainly posit this isn't an insignificant proportion of the total stock.

Buying a property and failing to either rent it out or live in it yourself is the absolute epitome of dead money

There are plenty of 'holiday homes' that fit that criteria.

@orangetrain: Please tell me what possible incentive do these characters have to keep empty properties in situation where vacancy rates are below 0.5% and people are bidding more to find a rental?

Answer: It’s urban legend and no one sane would do that in the current market.

@duchy: Possible incentive to leave it empty includes not acceptable for living, cost such as insurance, cultural (ie don't want to dirty place), no time to deal with tenants even with a PM and other factors.

If it's such an urban legend, then why are there so many properties with grass in between houses? Why do tall fences get put up around houses? These kind of properties stay around for decades, sitting empty.

Pretty much what I was going to say, saved me some time!

My reply to p1 ama's simplistic analysis:

Actually, if prices were much cheaper, people could save up a larger proportion of the house price in savings, leaving them psychologically in a much better position knowing that their loan is much smaller in comparison to their income.

Some people can find ways to pay off their loans faster even with higher interest rates by paying off the principal faster through extra repayments. This is much harder when the principle is ridiculously high.

Theoretically, some people could save up enough to buy an entire house without needing a loan, resulting in no money down the drain propping up bank profits. I wonder what proportion of the Australian economy is sucked into bank profits instead of into productive industries.

In reply to your simplistic example; "if rates were 30% and house prices were, on average, $100k, does that make it good for you?"

Hell yes! Anyone with a full-time job (especially couples) could save up $100k in 2 or 3 years, meaning the interest rate is irrelevant.The Australian economy and tax/banking system has been structured to reward those who own multiple properties (owning multiple properties is more rewarding financially than having an average full-time job), and to keep single-house owners as debt slaves for decades, and to keep everyone else as struggling renters watching house prices and rents soar while their income goes nowhere.

It's the scam of the century.

And at some point it's going to end. Society evolves, policies change, systems that separate people into different classes (e.g. wealthy property investors vs struggling renters) are eventually brought down.

Human society has been moving towards equality for hundreds of years. It will continue to do so.

My reply to p1 ama's simplistic analysis:

If you want to make a political point about housing affordability, then that's great - I also think that this is a structural problem that can only be resolved with fiscal / policy intervention.

However, the discussion was around the effects of monetary policy. I think you're suggesting something I didn't say, which is that somehow I want housing to be more expensive. I don't, I think it'd be great if housing was more affordable. However, monetary policy is not the way to get there. Resolving the housing issue is not a matter of "making houses cheaper", it is structurally changing how we construct society so that we do not have this illogical system of having millions of people cram into the city in the morning, then disperse to a 60km radius in the evening.

Happy to have this discussion, but it's not a monetary policy question.

In reply to your simplistic example; "if rates were 30% and house prices were, on average, $100k, does that make it good for you?" Hell yes! Anyone with a full-time job (especially couples) could save up $100k in 2 or 3 years, meaning the interest rate is irrelevant.

If you have $100K, and you buy a house instead of leaving it in a bank, it is costing you $30k each year. Every year you own that house, because you are not earning interest, you lose $30K. This means that housing is actually very expensive.

The Australian economy and tax/banking system has been structured to reward those who own multiple properties (owning multiple properties is more rewarding financially than having an average full-time job), and to keep single-house owners as debt slaves for decades, and to keep everyone else as struggling renters watching house prices and rents soar while their income goes nowhere.

I actually agree with you, but somehow you're trying to do a drive-by swipe at me?

If you have $100K, and you buy a house instead of leaving it in a bank, it is costing you $30k each year. Every year you own that house, because you are not earning interest, you lose $30K. This means that housing is actually very expensive.

Not really true. One of the main goals of owning a house is to own a house, not to become continuously more wealthy. Owning a house with no debt is an end goal that creates long-term stability, lasting wealth and happiness. Achieving this goal rapidly has a massive value that cannot be compared to earning $30k interest per year (actually $20k, because at least 30% will be taken in tax). By owning the house, you also do not need to pay rent, so I don't know how you are arriving at the conclusion that you lose $30k by owning a house.

Owning a house with no debt is an end goal that creates long-term stability, lasting wealth and happiness

It only seems that way because in the real world you earn nearly nothing by leaving your money in the bank, and that guides our desire to own houses outright since they consistently go up in value every year nearly without fail. But in this fictional world you could earn $30k (or $20k after tax).

In this fictional world you would be better off keeping the $100k in the bank and renting for $10k/year, you would get $10k passive income without doing anything. Owning a house instead of renting would be a very expensive luxury.

@Quantumcat: Not really, because in this fictional world, the high interest rate of 30% indicates a high rate of inflation, which means your money will be worth the same amount the next year, even with the $20k interest you earn this year. Plus you'll have to pay rent, which will probably be higher each year. Plus, renting does not = stability.

@ForkSnorter: That means buying a house is even worse, because the money can't grow anymore, you've frozen it in time by removing it from the bank.

Renting does not equal stability, which is why owning the house is an expensive luxury. If you don't want to rent, it will cost you

@Quantumcat: You are thinking about this like an equation of addition and subtraction. You're not taking into consideration the value of owning a house with no debt.

If you don't want to own a house, and prefer to instead rake in $20k interest per year, you are subject to all kinds of risks: the risk that that income will be nearly worthless due to the high rate of inflation; the risk that you will become redundant/lose your job before you buy a house or pay off the house; the risk that house prices will rise suddenly, or demand will increase massively; the risk that rents will rise suddenly; the risk that you will have to move every year or 2; the risk that the area you want to live in will become unaffordable, etc. etc.

We are talking about a fictional world where houses are very affordable in comparison to median wages. That is a nice world that a lot of people would love to live in.

Owning a house with no debt is an end goal that creates long-term stability, lasting wealth and happiness. Achieving this goal rapidly has a massive value that cannot be compared to earning $30k interest per year (actually $20k, because at least 30% will be taken in tax).

You still don't get the point. Owning a house is something you pay for, the question is how much you are paying. You seem fixated on the $100K number because, as Quantumcat below points out, you've probably only ever dealt with money in a world where the opportunity cost is next to zero, so you are very used to the idea that the value of $1 is simply just its face value.

When interest rates are 30%, this will absolutely not be true and you're failing to grasp that point.

I think you are reading into what I am saying from a moral point of view. I'm not making a moral statement about why you should or should not own a house or what the price of a house should be. I am simply stating that if it is your belief that higher interest rates are good for people, I urge you to rethink your position.

You seem a bit confused - for someone literally just railing against banks, you seem to have forgotten who's particularly happy about the rate increases. ANZ and CBA shares up significantly post-RBA announcement.

@p1 ama: You are also taking a simplistic view.

Imagine if the interest rate rise takes some steam out of the housing market, and prices drop 10-15%, not only because of mortgage affordability but also because of fear. That is $100k savings right off the bat. You may even save more due to not having to cough up an over-priced offer to compete with other buyers.

Not only will your mortgage be $100k smaller, you will also be paying less interest overall per month, regardless of the 0.25% rise in interest rates. If you repay the loan rapidly, well above the minimum repayments, you could pay your house off much sooner, and that $100k you saved off the purchase price will end up being a massive difference, potentially saving you years of repayments.

In this scenario, you won't be making very much interest on your savings if you chose not to buy, I can assure you. The more the prices drop, the better.

And the psychological factor is important too. Having a large mortgage is a source of anxiety, stress, fear. Surveys have found large mortgages are negatively correlated with self-reported happiness/life satisfaction.

@p1 ama: Why are you failing to grasp or ignore the point that assets can be overvalued, fairly valued, or undervalued?

Do you think low interest rates have perhaps pushed some buyers or investors to bring forward their purchase decision as other posters have suggested? So say in a normal environment, there are 10 buyers competing for a property but now there is 15. What do you think this does to prices?

Given your experience in economics, what do your economic models tell you about property valuation today? Or what do the basic valuation metrics e.g. house price to income tell you?

So if property is overvalued (and I want your opinion on this), why wouldn't higher interest rates be better for the average buyer who has been on the sidelines?

@blues86: I think higher rates are better for someone looking to buy a home (vs investment). If rates push up and subsequently savings accounts and term deposit rates investors have alternatives to consider. Home owners don't. Good luck living in a term deposit!

With regards to value it all comes back to "a willing buyer and a willing seller.." so certainly where undue influence on either side doesn't exist, i.e. a clean, legitimate auction the price is the price. But then your point was value and value is what it is to individuals so two different things aren't they.

Why are you failing to grasp or ignore the point that assets can be overvalued, fairly valued, or undervalued?

I'm not. Will explain as I respond to your points.

Do you think low interest rates have perhaps pushed some buyers or investors to bring forward their purchase decision as other posters have suggested?

I agree that rising prices have pushed buyers to bring forward their purchase decisions.

Low interest rates are only part of the explanation for higher prices. I agree that, in general, discretionary spending was down significantly during COVID, rates were low, people wanted to seek yields, naturally this pushes up asset prices. This is obviously all basic stuff and I agree.

My argument the entire time is that this is not an issue that monetary policy will fix. Twiddling with interest rates will change some behaviours around consumption / investment / savings decisions, but ultimately a 0.25% change in the cash rate will not fundamentally change the "affordability" of a house.

Given your experience in economics, what do your economic models tell you about property valuation today? Or what do the basic valuation metrics e.g. house price to income tell you?

They tell me that the fundamental issue is not a financial problem, but a planning problem. It is the fact that the way we live (or want to live) has not kept up with the rapid increase in population and the rapid development of technology that we have seen over the past 20 - 30 years.

We have not built the infrastructure that will allow people who live further away from the city (i.e. good public transport, like high speed rail) and still get to work in a timely manner, driving up valuations in blue ribbon suburbs even further as outer suburbs become places people do not want to live.

We have not invested in things that families need, e.g. schools, in the right locations. All of the highest performing schools are still located in very specific local areas that are the most expensive.

We have not adjusted to accept living in higher density the way that cities the size of Melbourne and Sydney are approaching (think New York, Singapore, Tokyo, Hong Kong, London). In fact, there are loads of good apartments close to the city centre that are far larger than the average apartment size in the above cities I've listed that sell for ~$500K.

We have not dealt with the fact that as manufacturing jobs transition to office jobs, that there are going to be higher demands placed on the inner city and transport networks. Additionally, we have not dealt with the fact that the increase in WFH has been a great opportunity to develop regional and outer suburban areas to cater to people who want a WFH lifestyle whilst offering them great living standards.

The issue is that, on average, valuations are blowing up (e.g. house price to income ratios, let's say, as you mention this). However, averages are skewed by expensive suburbs and are not taking into account the realities of the increase in population and wealth that we have seen. Once upon a time, if you were an accountant (let's say), you were upper middle class. Today, you're probably in a percentile that would be considered working class (in terms of income).

So if property is overvalued (and I want your opinion on this), why wouldn't higher interest rates be better for the average buyer who has been on the sidelines?

Because property is not overvalued IMHO. Values keep on rising because we have not made the investments necessary to increase housing stock and to make new areas livable. As more and more people chase after houses in blue ribbon suburbs, real values will increase because these people are richer.

As to why higher rates being better for the average buyer on the sidelines? It won't make any difference. Prices might be (nominally) lower, but they are also more constrained by borrowing capacity. It doesn't change the fundamentals.

If you really want to understand what the problem is, it's that an obscene amount of wealth is tied up in housing at the moment. This is why no major political party wants to take any action that will make housing more afforadble because it means the erosion of wealth of the majority. This is why all the "first home buyer" schemes are demand side schemes that will only push prices even higher as they increase demand. Basically, taxpayers end up (partly) subsidising investors when their valuations go up.

@p1 ama: I think you are still taking a massively simplistic approach in pushing your idea that "lower prices + higher interest rates = nobody is better off".

You're not considering all the factor involved.

The higher interest rates will affect everybody, including those who bought at the peak. If you buy for $100k cheaper than somebody who bought when house prices were at their peak, you will be $100k better off than them. After their fixed rate period ends, they're back on the same rates as you.

Some people do not reach their maximum borrowing capacity when they buy a house. So the higher rates won't affect them in terms of mortgage affordability.

Some people prefer to pay off their mortgage at breakneck speed, making massive extra repayments. This means they pay off the house years (decades) earlier, avoiding hundreds of thousands extra in interest. For these people, cheaper prices are a larger factor than the interest rates because the principal repayments will constitute the overwhelming bulk of their repayments.

Interest rates on savings accounts are much lower than interest rates on mortgages. PLUS that interest is taxed the full amount (no discount). The interest rates on savings accounts also reflect the inflation rate, so even if your savings grow through interest, the value of your savings does not increase. The house, on the other hand, has an absolute, intrinsic value that does not decline over time.

Owning a house with no debt is an important end goal that massively improves the long-term stability, wealth and happiness of Australians. This is easier when prices are lower if you have a large deposit and smaller mortgage, and if pay off the principal portion of the mortgage as fast as possible (because the higher interest rates will have less of an impact).

@p1 ama: Right, so houses are not overvalued in your opinion.

Have you actually looked at the breakup of house price to income across different states, area etc.? What has been the delta say over 10 years?

Over the 12 months to Apr-22, house prices have increased 16.7%. So if supply has been a LT issue (I agree), but have people have just realised oh shit there’s a supply issue so we to get into the market all of a sudden? Hint: look at the direction of interest rates

No 25bps is not going to make a big difference, but let’s see what happens if interest rates normalise.. I’ll make a bet with you that a couple with stable incomes will be better positioned from an affordability standpoint.

I do feel for the buyer who has stretched themselves in the recent period to get into the market under the false pretence by our RBA governor who made a stupid statement that the cash rate will not increase.

lasting wealth and happiness.

It doesn't create wealth in that world since cash in the bank at 30% is clearly the better investment to build wealth. If being wealthy equals being happy, then it also doesn't result in happiness unless the house itself brings happiness and money is of no consequence.

@meumax: Not really. A world with 30% interest rates is a world with extremely high inflation. So even if your savings grow through interest (after tax you will be left with 20% interest), the value of your savings does not increase. The house, on the other hand, has an absolute, intrinsic value that does not decline over time.

Previous surveys have clearly shown that older Australians who owned their own house outright were generally healthier and happier. Older Australians who had mortgages had lower levels of happiness.

@ForkSnorter: True. But then the home owner is disadvantaged in consumption because they don't even have a bank account of dollars treading water with inflation to buy things from the shop.

The renter who doesn't have to front up the $100k cost of the house can park their cash at the bank and at least maintain their purchasing power relative to the price of goods. Or they can park it in more risky assets to beat inflation and increase their spending power. This is the opportunity cost of the home owner.

They have the home and all the intangible benefits that brings (renovate at will, pets, sense of security etc). But at the expense of growing their spending power for consumption compared to the person who invests/saves the $100k.

It may be the case the intangibles are worth the cost. IMHO, this is where we're all falling down in this discussion as the people who would like a $100k house with 30% interest rates probably place a very high monetary value on those intangibles, more than the straight economist types here.

Edit: If we can't agree on a value to the intangible benefits of home ownership, then its going to be very difficult to quantify the best course of action. My gut feel is Australians value them highly. But that's been shaped by the world we live in today. Would they value them as highly in the theoretical world we're discussing? It's hard to say.

@meumax: If you have $100k and get $20k per year interest (after tax), you still need to pay rent. If you spend any of the money you make in interest, your savings will continue to decline in value over time. The home owner has a house that will theoretically be worth $20k-$30k more after one year. At least they can grow potatoes in the backyard if there is a Great Depression. The person relying on their $20k interest per year may not be able to.

The house, on the other hand, has an absolute, intrinsic value that does not decline over time.

Excellent point. I am now definitely leaning toward the house purchase as an inflation hedge in the theoretical scenario!

The problem then becomes, how to get one when everyone else wants to do the same thing.

Something can be cheap (like toilet paper), yet run out before everyone can get one due to supply shortage and demand increase.

As A1 said in the original comment, if there are 5 homes for sale and 10 buyers, if you're the 6th richest guy, you're still goanna miss out.

To solve the housing problem, developers/Govt also have to step up to build enough homes of the quality and in the location people want.

@ForkSnorter: "By owning AND LIVING IN a house you also do not need to pay rent".

Exactly, which is the same as getting that $30k in income. So even when you buy a house to live in, you are an investor - paying out wealth to get a flow of future returns (in this case the return is money you don't spend on rent). But if you are not living in it, or you are not renting it out, you are getting no return on investment - it's dead money.

@p1 ama: Totally agree re: cramming into the CBD. I think Big corporates, government and society have never had a better chance to change this.

Shame if everyone ends up back in the CBD(s) again post this extended WFH period when the benefits are numerous to retaining a significant WFH element for a number of workforces.

@drprox: Why not both? WFH may be a permanent change to society. But high density CBDs still provide numerous benefits, the most important of which is efficiency. In the long-term this efficiency will have massive environmental and financial benefits.

Living out in the sticks will always be comparatively wasteful in terms of energy, time, manpower, etc.

And a long-term tree change/sea change trend in Australia will eventually destroy the remaining wilderness, turning it gradually into urban sprawl.

Hoping house prices start to stabilise, if not drop a bit, for those of us trying to buy. Hopefully…