A rise after 11 years. Interesting times. How will OzBargainers be affected by this? Keen to hear your thoughts.

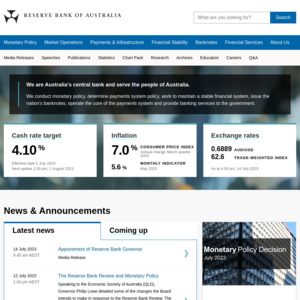

RBA Raises Interest Rates by 25 Basis Points

Related Stores

Comments

Great buffer! Well done mate.

There's been news that RBA will raise rates to 6%, so you might need that buffer soon if the banks just pass that straight onto us!

hope so. raise it sky high

The reality is that the conservative Liberal Party (the Coalition) does not want affordable houses, nor do they want you to own your house outright.

They want you to stay a debt slave for most if not all of your working life. Because that way you support the economic system that keeps them in power and that maintains their wealth and the value of the multiple properties they each own.

Why do you think they're always talking about helping people get into the property market, but they never talk about helping people own a property outright?

Furthermore, the Liberal Party (Coalition) knows that homeowners with large mortgages tend to vote conservatively, partly because they're paranoid the value of their house will decline if Labor achieves power.

This has been the strategy of the Liberal Party for decades: "Keep house prices high, encourage Australians to take out large mortgages, and Australians will tend to vote conservatively."

That's why many of the policies they implemented during the pandemic are consistent with the goal of maintaining/increasing property prices.

"Why do you think they're always talking about helping people get into the property market, but they never talk about helping people own a property outright?"

Okay here is a property you can own outright, 0% interest on 50years contract all covered by tax payee, while we are at it here are free cars, free overseas holiday.

Is that what you are hoping? If you can't save deposit money to buy a property, there are a lot of way to achieve them through shares / stocks, funds, etc. I for sure not wanting government to help people own a property outright, but helping them to get into the market is sufficient.

Feel free to pay interest on your debt your entire life. I won’t. Mortgages are the new rent.

Obviously your life your choice, instead of whinging and complaining / regretting in the future I choose to pay interest rates. Graphic and chart of house prices in Australia past decades has led me to invest in property.

Mortgages are the new rent. Yep, with the added benefit of being the master in your home and owning a significant asset after 30 years. Helps prevent the scenario where your grandchildren end up slaves to their landholders and crying foul on future Ozbargain. Through history the act of acquiring and holding territory has often been through the combined effort of generations.

@tonka: Not to mention, in most cases the mortgage repayments are significantly less then rent payments.

For example, I bought a house in November last year, my mortgage repayment is about 41% less than what my rent was…

@tonka: I’m certainly not recommending that people don’t invest in property. What I’m saying is, don’t buy beyond your means. Too many people bought beyond their means even before the pandemic, and then during the pandemic taxpayers had to bail them out with fortnightly payments and mortgage freezes. That money should instead have been allocated to health, education, construction of affordable housing, or investment in future industries. But because everyone bought beyond their means, they needed a bail out.

And then once property prices went up 20-50% suddenly everyone wanted to buy a house. It’s like Australians aren’t thinking for themselves and just following along with the herd. Why didn’t you buy 2 years ago when prices were much lower and interest rates were only a little higher? You’ve effectively lost $200k-$300k by buying at the peak. Plus you will pay interest on that $200k-$300k. You’ve extended your debt-slavery and your working life by 5 years or more.

The point of the above quote is to highlight the fact that interest rates cannot rise by too much without causing serious damage to many people's finances. It's more likely that we would see something like this:-

The cash rate going to +5.0% isn't going to happen.

That's the point. It's highly unlikely.

Even returning interest rates to "neutral" is going to hurt a lot of people. Prices would go down significantly.

He makes a simple point - why think that a fall in interest rates can cause house prices to rise 30%+ (which they did), but when interest rates rise the reverse can't happen?

Pretty basic stuff.

LOL I remember Christopher Joye.

He sings the song of whatever can be controversial.

Bull, to a bear, rinse and repeat.

Please point to a forecaster more accurate than Christopher Joye on house prices in the last 10 to 15 years.

Dis gun b goood.

Low interest rates benefit spenders and speculators. They encourage consumption with borrowed money and provide cheap credit for asset speculation (shares just as much as property). They punish savers and those who live off their savings (retirees) - especially if inflation is higher than interest rates. Anyone who saves and invests (i.e. spends less than they earn) should logically prefer higher interest rates - especially with rising inflation.

Anyone who saves and invests (i.e. spends less than they earn) should logically prefer higher interest rates - especially with rising inflation.

High inflation and cash rate hikes will rekt people that keep savings in fiat 💵.

Nothing to do with keeping savings in fiat. A true property investor is better off with higher interest rates because prices would be lower and yields would be higher, giving a better return on the investment. Debts on a property can be paid off faster from savings.

With ultra low interest rates, property "investors" are really speculators, taking on large leverage to buy assets that lose money in the hope that the asset value will appreciate to make a profit.

Pretty much the same situation with shares.

I like hard assets with growth.

Divs and rent are for suckers.

100%

Only .25%?

Come back and ask again when it hits 2.5%.

RBA will have little choice when rest of the world is jacking up rate. RBA will needs to do so to avoid major capital outflow.

Before I took out new investment loan I based my repayments on an interest rate of 7- 8.5%.

Did the calculations(including cutting literally everything expense back-did detailed budget check-) and went ahead with the loan assuming repayments may get that high in the future.

I remember when my home loan interest rates were 17% in the 90’s. Once burnt. Twice shy. Wasn’t getting caught out twice.

Interest rates may not get to 7-8.5% but if they do at least I know I can still make the repayments and if you don’t think that way your asking for trouble.