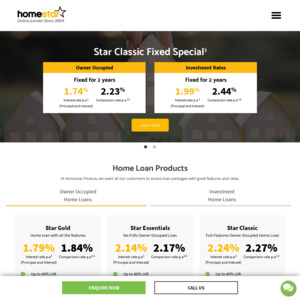

HomeStar are offering a fully featured variable owner occupier home loan for just 1.79% - I think this is the lowest you’ll find at the moment (correct me if I’m wrong). You need to have an LVR of 60% though. DYOR :)

Loan Features:

Visa Debit

Offset Account

No Monthly or Ongoing Account Fees

Weekly, Fortnightly or Monthly Repayments

Free Online Redraws

Super Low Rate

Unrestricted Extra Repayments

Multiple Loan Splits Possible

Pay Anyone & BPAY® Available

Schedule Recurring Payments or Transfers

This is a Limited Time Special, only available on applications received by 31.12.20 and settlement by 31.03.21.

Can't find details on application and discharge charges. Any ideas please?