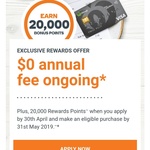

Received this in my email. Seems to be targeted offer. Save your annual fee when you apply via the link in the email.Plus, you can't get 20k reward points (worth $100).

A good card for your monthly shopping in Woolworths. Receive 10% off on selected dates, valued up to $50.

T&C

Offer is limited to new applicants only who apply by clicking on the link through this email. To be eligible for this offer you must apply for a Woolworths Everyday Platinum Credit Card between 12:01am (AEDT) 31 March and 11:59pm (AEST) 30 April 2019. Primary or additional cardholder annual fees may be introduced or varied in future. You will not be eligible for the $0 annual fee offer if you do not apply through the link in this email.

~ 20,000 bonus Woolworths Rewards Points offer is available to new primary cardholders only who apply for a Woolworths Everyday Platinum Credit Card between 12:01am (AEDT) 31 March and 11:59pm (AEST) 30 April 2019, are approved and make an eligible purchase on their Woolworths Everyday Credit Card by 11:59pm (AEST) 31 May 2019. Your 20,000 bonus Woolworths Rewards bonus points will be credited to the Woolworths Rewards membership provided at the time of applying for a Woolworths Everyday Platinum Credit Card within 8 weeks of the eligible purchase, provided you are not in breach of the Credit Card Conditions of Use and your account remains open. An eligible purchase is any purchase excluding balance transfers, cash advances, cash substitutes and transactions for gambling purposes. Woolworths Rewards program terms and conditions apply. Woolworths Rewards is not available in Tasmania. You will not be eligible for the 20,000 bonus Woolworths Rewards Points if you do not apply through the link in this email.

I got the email. Also mentioned 14 months 0% balance transfer for those so inclined.