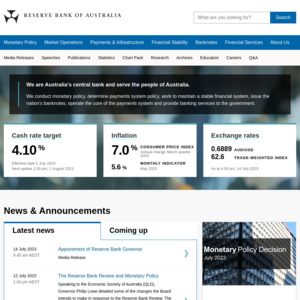

The RBA has cut the cash rate for the first time since 2020. This might be a relief for homeowners, but is inflation really under control?

RBA Cuts Cash Rate for The First Time Since 2020

Last edited 18/02/2025 - 14:47

Poll Options

- 32Banks will cut rates immediately

- 340Banks will cut rates within a month

- 15Banks will cut rates within a week

Related Stores

Comments

Do you have numbers to support that?

This is based on the analysis done by UNSW, it's a good read as it actually factors in the on-going maintenance and operational costs, balanced against rental yield from social tenants: https://cityfutures.ada.unsw.edu.au/documents/522/Modelling_…

The cost to build can be borrowed, as you're left with an asset that can be sold for a profit later, similar to what previous governments did as house prices go up in an area.

The median cost to build a house in Australia is around 400k that does not include land

A huge part of that $400k is taxes, permits and fees, which the government doesn't pay to itself. The government also owns significant amounts of land, both greenfield and brownfield, so land costs are largely just decontamination and clearing. And the government has access to much lower interest rates and financing, especially for building assets that will appreciate in value.

the average tax take in australia is 24K. To me that indicates that the they would need to collect tax for 16 years to build one house and 32 years for 2 and supply no other services to them

Going by the figures in the analysis, a hypothetical immigrant paying $24k in tax who received no government services could fund 4 houses in Victoria each year. Realistically, they'd probably use at least $10k in services, so 2 houses.

And remember, if they're in couples like you said, then that would be 4 social houses for every 1 occupied, sweet deal ain't it?

In 2024 there were 170719 houses built in Australia, and the population grew by 446 000. Even is we said they were all couples that still leaves a deficit of well over 50k houses.

In 2024 we had 667000 people arrive from overseas in Australia, who stayed here for 12 months or more over a 16-month period. 221000 people left in the same time period.

Keep in mind that 465000 of the 667000 arrivals in 2024 were people on temporary visas, 90000 were visitors, 80000 were working holiday makers, 49000 were temporary skilled migrants, and 207000 were temporary students.

Of the remaining 202000 arrivals, 60000 of them are Australian Citizens returning home from aboard, 51000 of them are New Zealand citizens, and 91000 are permanent visa holders.

The vast majority of temporary arrivals are living in shared accommodation, you're not signing a lease or buying a house as a working holiday maker or visitor are you? Students are the biggest one, can definitely feel the impact in rent prices around universities, but there are hundreds of student accommodation buildings for that purpose too. From a glance, there are 132700 student accommodation beds in the country, so this surge is somewhat mitigated but more should be done.

The majority of the temporary skilled migrants, New Zealand citizens and returning Australian citizens would need general accommodation though, as would a lot of the permanent visa holders.

But I'm sure you've been sold the 446000 number by someone spinning a story, presenting it as permanent immigrants settling here in family homes.

Then the imapct on infrastructure that is battleing to keep pace with the increaseas and the decreases in productivity while transport is stuck on roads that were built for a much smaller population. This pulls resources from the housing sector into goverment projects and pushes up construction costs for all.

Definitely agree, we've been underfunding transport for decades. I think a good middle-ground is restricting skilled immigrants from living in capital cities for a period of time.

Going by the figures in the analysis, a hypothetical immigrant paying $24k in tax who received no government services could fund 4 houses in Victoria each year. Realistically, they'd probably use at least $10k in services, so 2 houses.

And remember, if they're in couples like you said, then that would be 4 social houses for every 1 occupied, sweet deal ain't it?

Everyone of those models has a cost to government and where the gap is lower relies on a capital grant.

I would hazard a guess that anyone paying 24k in tax in AU is net negative in services and contribution to the running of the country. Its around 2k per person for defense alone, like 8K for pensions and around 9k for health another 1k on roads the list goes on.

As I mentioned before not against immigration but we need to catchup first. Bringing more people in is not the silver bullet to our housing problem.

No, a property of certain size at certain location is worth a certain value. The value doesn't increase or decrease per ownership structure.

A property valued at X is expected to rent for Y per week, it doesn't matter if it's 80% mortgaged or fully owned. So interest rate changes have no direct influence on rent.

Investors may increase rents due to mortgage stress, but only if there are tenants willing to pay the increased rent.

Investors may increase rents just because neighbouring properties have increased their rents, but only sustainable if there are tenants willing to pay the increased rent.

Similarly, investors don't have to decrease rent went tenants are happy to continue with the current rent.

So rent is largely a function of supply and demand.

That doesn't make much sense. If Y is based on X, and X is impacted by interest rates (prices go up with lower rates and vice-versa), then Y is impacted by interest rates.

A house worth $1 million will rent for more than a house worth $800k, and that $1 million house was once worth $800k.

The rental yield fluctuates based on the market, but that's just a multiplier based on the price.

A property can be fully owned, so interest rate doesn't play a part, but supply and demand do.

Rental yield is a percentage of income over property value, it doesn't factor in expenses such as interest payments.

@browser: I think you might have misunderstood me, I didn't mean that expenses like interest payments affect rent, but rather that interest rates affect house prices.

Like if the agent fees or the water supply charge increase, then that doesn't affect rent, because the rental yield doesn't fundamentally change.

But if interest rates go down and house prices go up as expected, then the yield does fundamentally change and rent does increase.

The target yield varies depending on the type of property and the market, but 3% of $800k is less than 3% of $1m. Like how the supermarkets are making record profit because their profit margin percentage largely remained the same, but the base price of their goods increased dramatically.

@Jolakot: Got you.

My original comment was intended to shoot down any expectation of immediate rent relief.

So glad we have that hack's useless, unwanted opinion. I can sleep easy now.

sorry, but I happen to agree with him

Even as a mortgage holder, I think we needed 1-2 more rate rises just to get the message through, tbh. Sad that the RBA is just a political branch of the government of the day now. The economy needs to become more efficient and diversify out of reselling houses to each other, and lowering rates again is just a price signal telling us to do more of the same thing that isn't really working.

Don't forget that the way CPI is calculated is fundamentally a scam. It measures what people actually buy, not what the same things cost over time.

If you start eating tinned cat food for $11 per kilo because you can't afford beef that went from $10 to $20 per kilo, this would be measured as 10% inflation rather than the 100% that the beef price actually went up because you're now spending $11 instead of $10 on the meat category…

So if they're telling us CPI is 2.5% it's more likely at least 6% of actual price rises. Everyone who goes into Coles and gets out their card knows the reality. On top of that they seem to love excluding anything out of the ordinary from the measure, so yeah if you leave out the main things that matter then of course it looks like nothing happened.

Don't forget that the way CPI is calculated is fundamentally a scam. It measures what people actually buy, not what the same things cost over time.

I don't think this is right - I'm pretty sure the CPI uses a "basket" of goods that they track over time, I don't believe it changes regularly depending on actual buying habits?

It’s updated annually.

This tracks. My orange juice has gone up from $4.60 to $5 in the last year-ish.

Sad that the RBA is just a political branch of the government of the day now.

Brain-dead understanding

mmmmmmmm tinned cat food.

Can you recommend a brand please, preferably beef flavour.

Westpac already has in my app a notice saying my interest rate will go down on March 4 by .25% which is the full cut 🥹

Meanwhile my savings in BOQ remains 5.5% though I’d expect that to change next month…

TBH, while it is very welcome 0.25% p.a. isn't going to change anything for me.

$1m deductible mortgage.

Over the last 3 years, I've had massive increases in land tax and insurance premiums relating to my rental properties.

Also if you have diversified investments, such as shares, the market is down after the interest cut, lost more there than small interest reductions on highly offset mortgages.

Good point.

However had I invested in shares 3 years ago rather than property, I'll be way up. Property since I purchased it 3 years ago has barely moved (unfortunately I didn't buy in QLD or Perth)

I have shares in my super but property outside of super as I can borrow 100% to fund the purchase of the property.

You can use equity in your property to buy shares and claim the interest costs aswell.

@tomfool: Yes I know.

There's never a perfect time to invest, though with current sharemarket valuations and economic uncertainly, I don't want to be jumping into the sharemarkets right now.

However, I need to properties to increase to then draw the equities.

A stupid move by the RBA that will only increase house prices and push the barrier higher for home ownership.

It really won't make much of a difference. We, as a country, are addicted to housing. And we're addicted to pumping up its price as fast as possible.

Adelaide, a once affordable city, saw a 14.5% average house price rise in 2024 alone. No interest rate cuts were required to achieve that.

So you actually agree that it will make a difference, as slight as it may be.

Wait till we have another cut and another after… then all these slight differences will add up… And adding up in the wrong direction.

High inflation is due to bad immigration policies.

We need Labor kicked out of the parliament house.

Incoming government should bring in sustainable immigration policy.

The fact we have here is the Australia is not capable to handle large population. There's not enough infrastructures and supplies to cater sudden surge in immigration.

A large portion of those came are assylum seekers that come with nothing but additional burden to already declining life quality of existing residents.

@4253-716HT - Liberals aren't any better and historically have proven to be worse.

Australia needs migration to grow its population. The issue is neither government on a Federal and state level invests properly into infrastructure to manage this properly.

There are countries with more than 2 - 3x our population and they manage infrastructure much better.

The world needs humans to reduce breeding. Australia's environment is already fecked and water is abused beyond capacity. We will be like the middle east in 20 years. Hot, dry and a shit place to exist compared to what we lost.

Australia doesn't need migration, big business and capitalism does.

@Protractor - The environment isn't fecked, there's areas regenerating and water abuse is not due to migration, but due to poor management by governments.

The government needs immigration for income tax and GST, to bolster up services it provides.

All the things you mentioned can be sorted with good government management and policy. Something we haven't had in decades.

@StonedWizard: Appropriate username.

Dream on Liz. That's some powerful idealism drug you got going on.

@Protractor: @Protractor - 85% of Australia’s population live within 50km of the coastline.

Sydney (largest population) gets regular rain and has a desalination plant.

There is absolutely 0 reason for the coastline to experience water shortages, except for bad policy and wastage.

We have an aging population and will continue to without migration. This will result in jobs/skill shortages and less tax revenue which will see every day services diminish. Such as healthcare, education and infrastructure etc.

Remember we allow our natural resources to be raided by billionaires. With only cents on the dollar going back to the population.

@StonedWizard: Yes energy is free,hoorah ! There's no side effects.Ooh, and no hyper saline water to worry about.

This someone has to wipe our arse in old age argument is puerile outdated nonsense. Designed by and swallowed by simpletons addicted to short term gain,greed and stupidity.

Everything you state is science free hyper economic BS. You should go into QLD politics with Matt Canavan.We don't need more ppl, we need more smart ppl. Ones who put science before personal gain, or we all fry in the same pan.

Yay, we can desal our way to the promised land LOL

The only thing you forgot was drill baby,drill.BTW, "bad policy and wastage" defines Australia since Cook arrived.

Don’t worry Labor will massively ramp up migration with CECA. Housing equity is SAFU.

Someone has to do the real work. We can't all goto University to study philosophy and the arts.

you forgot political science and psychology

So true. Where would this country be without next-day Catch.com.au delivery

And liberals will sell all the public housing, public companies and infrastructure to overseas companies to make up for the debt they incurred

Yay! We could be the nuclear waste dump of the southern hemisphere.

Oh wait.Once the Gaza Netanyahu/Putin/Kushner/Trump Riviera development is done the same snake oilers will be coming here, and neither side of govt will say no to their plans

It’s absolutely disgusting the assets which the Liberals have flogged off for cheap. CSL, CBA, Qantas, QR National/Aurizon…

Hold on, they were all flogged off by LABOR 🤪

The 3 cents a year I'll save off my mortgage will be cold comfort when they cut savings rates.

Both will move opposite directions of. 25%… So you must have 500k in your savings account, and a 5K mortgage?

Might want to engage a financial advisor there there champ

5K mortgage

0.25% of $5k is a lot more than 3c.

Clearly I was illustrating a point and not being literal with figures and receipts

Woolworths is still increasing the price of items (compared to a month ago). With this rate drop we still do not know what will happen next. It could possibly even go back up again.

Woohoo, housing pricing to go 🆙 ⬆️

Unemployment is barely above the 10 year mean

Yet supposedly we're weak…?

Someones trying to prop up the housing market

We've been in a per capita recession for over 18 months. Sure, the economy is barely growing, but our population is growing faster. As far as I'm concerned per capita GDP is more important than gross.

inflation has gone down

My lender has already applied the cut to my loan.

@Jolakot: Do you have numbers to support that? The median cost to build a house in Australia is around 400k that does not include land, the average tax take in australia is 24K. To me that indicates that the they would need to collect tax for 16 years to build one house and 32 years for 2 and supply no other services to them. So unlesss all these skilled people are in the top 1% of earners there is no way they tax revenue positive.

In 2024 there were 170719 houses built in Australia, and the population grew by 446 000. Even is we said they were all couples that still leaves a deficit of well over 50k houses.

Then the imapct on infrastructure that is battleing to keep pace with the increaseas and the decreases in productivity while transport is stuck on roads that were built for a much smaller population. This pulls resources from the housing sector into goverment projects and pushes up construction costs for all.

I am not against immigration but when the exisiting populaiton does not have enough housing and infrastructure is buckling its time to slow down catchup and review.