Exclusive referral deal, slightly higher compared to the 145k points offer in May.

Use the 'Show x More' option in the REFERRAL LINKS section below, scroll to 'Explorer' and use the random link option for your link to get 150k points.

150k points is more than enough for a one-way business class trip to Singapore with Singapore Air (post-Covid) or a 5 nights stay in a Marriott category 3 hotel in Australia. If you're not into travel, you can use it as a $750 credit/cashback instead (arguably the worst way to monetise your points though).

Happy to answer any questions on the best way to use AmEx points, I've redeemed many of them over the years with Singapore Air, Korean Air and Marriott/SPG. Comes with a $400 travel voucher to offset the $395 annual fee.

Referrers can receive 40k points, depending on their account status.

Card Type

Annual Fee: $395 p.a.

20.74% p.a. interest rate on purchases

Up to 55 Interest-free days

Other relevant bits:

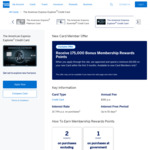

Receive 150,000 bonus Membership Rewards points when you spend $3,000 in purchases on the Card within your first 3 months. This offer is available to new Card Members only

Earn up to 2 Membership Rewards points for every $1 spent on eligible purchases

Enjoy $400 to spend on travel each year4 that can be redeemed on eligible flights, hotels, car hire or experiences when booked through American Express Travel

Enjoy two complimentary entries per year to the American Express Lounge, located at Sydney International Airport or Melbourne International Airport

Transfer your Membership Rewards points to a choice of 9 Airline Partner Programs

Smartphone Screen Insurance for up to $500 for screen repairs to your Smartphone when you pay for your phone or monthly contract with your American Express Explorer® Credit Card

Eligibility

Before you apply for your American Express Explorer® Credit Card, make sure you can say yes to the following:

I am aged 18 years or over

I am an Australian citizen or permanent resident or hold a current Business Long Stay Visa (subclass 457)

I have a personal gross (pre-tax) annual income of $65,000 or more

I agree to access my statements online through American Express

I have no history of bad debt or payment default

Bonus & Eligibility.

150,000 Bonus Membership Rewards® points are only available to new American Express Card Members who apply online For the American Express Explorer Credit Card by 3 November 2021, are approved and spend $3,000 or more on eligible purchases on your new Card in the first 3 months from the Card approval date

Card Members who currently hold or who have previously held any Card product issued by American Express Australia Limited in the proceeding 18 month period are ineligible for this offer. Eligible purchases do not include annual Card fees, cash advances, interest, balance transfers, fees and charges for traveller’s cheques and foreign currencies. Please allow 8-10 weeks for the bonus points to be credited to your Account after the spend criteria has been met. This advertised offer is not applicable or valid in conjunction with any other advertised or promotional offer.

OK offer, but for those wishing to sign up, some members have targetted "exclusive" referral offers, for 175,000 MR points for applicant, and 50,000 points for referrer. I received it but not the Mrs. account. Total of 225,000 points given out. Best to check with friends & family, or help out a fellow Ozbargainer.