Just now I got this email from Athena…

You've been dropped!

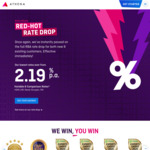

At 2.30pm today, the RBA (Reserve Bank of Australia) announced a drop in the cash rate of 0.15%. We’ve decided to pass on the entire rate cut to you straight away.

Thats why I love them…

The more you pay down your loan, the more we’ll lower your rate. Automatically. It’s an Aussie first!

Pay down your loan sooner with:

ZERO Athena fees

Free Redraw

Automatic rate match

Drop your own rate

Agreed, particularly in the current market where cash backs are becoming common. I am waiting to see if Westpac pass on the cut for the 2.29 variable with 3K CB