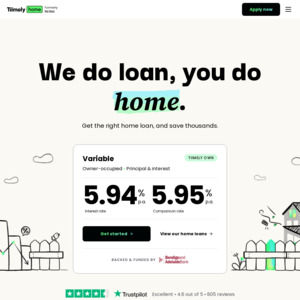

Tic:Toc have lowered their home loan rate for new customers looking for a Variable P&I Live-in home loan. Make the switch to Australia's leading fee-free Variable P&I Live-in rate and you could access savings faster. Fast Refi for eligible loans.

Loan features

- Bank-backed and funded by Bendigo and Adelaide Bank

- Maximum 90% LVR / 10% deposit

- No upfront or ongoing fees

- Optional offset available for $10/month

- Unlimited additional repayments

- Free online redraw

- Up to 30 years loan term

- Full online application with expert support

Eligibility

- Must be refinancing or buying an established property (not off-the-plan or under construction)

- Property must be located in a capital city or major regional centre

- Minimum 10% deposit or equity, plus savings to cover government/third party fees such as stamp duty. Lenders' Mortgage Insurance (LMI) payable with less than 20% deposit

- Loan amount between $50k and $2m

- Employed – either PAYG, or self-employed for at least 2 years

- ID – passport, driver's licence, or Medicare card

- Open to Australian citizens or permanent residents who live in Australia

Unlock more options

If you’re not eligible for a Tic:Toc loan, your application can unlock more options via Tic:Toc’s in-house broker service, Tic:Toc+Choice.

Optional offset account

- Get an offset account with your home loan for $10/month. When you choose an offset account for our Variable P&I Investment Home Loan, the comparison rate will be 5.81% p.a.

- Our 100% offset accounts are optional and available with all of our home loans (even fixed rate home loans). They fall under the ADI licence of Bendigo and Adelaide Bank and are covered by the Financial Claims Scheme. Offset accounts come with a VISA debit card 💳 You can find more detail here (tictoc.com.au).

Legal things about our rates

They're current as of 14 August 2023; available to all home loans approved on or after this date, and they can change. Our comparison rates are calculated for a $150,000 loan over 25 years. They factor in our fees associated with applying for the loan; our ongoing fees and our fees associated with leaving the loan. Our fixed loans roll to a variable principal and interest rate at the end of the fixed term. If the interest only period is not specified, the comparison rate is calculated on a one year period.

WARNING: The comparison rates are true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Tic:Toc Home Loans. Australian credit licence 496431. ABN 41 605 696 544

Inb4 tiktok files a cease a desist order for using a similiar name