Tic:Toc's Rate Match Offer

We haven't met our match when it comes to great home loans.

If you can find a lower cost identical variable P&I home loan, we'll match it!

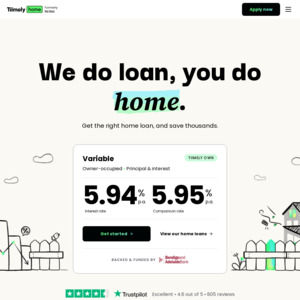

Our current Variable P&I Live-in Home Loan: 2.09%p.a. with 2.10%p.a. comparison rate. 2.24%p.a. comparison rate with $10/month offset account.

Our current Variable P&I Investment Home Loan: 2.39%p.a. with 2.40%p.a. comparison rate. 2.53%p.a. comparison rate with $10/month offset account.

Plus, there's more:

💸 Offset account for $10/month

💰 No Tic:Toc fees

🏦 Bank backed

💬 Home loan specialists available to chat 7 days a week

💻 Apply online, anytime

Terms and Conditions

If you’ve seen a lower rate for an identical variable P&I home loan product, and you’re applying for a loan from 1 June 2022, we’ll match the rate. This offer is available to customers eligible for a Tic:Toc Live-in or Investment home loan purchasing or refinancing a property from another financial institution. The rate will be honoured if the rate appears in your loan contract which must be accepted by you under the normal terms of the contract. This offer may change or be withdrawn at any time. This offer is subject to normal lending criteria and government charges. Excludes refinance of existing Tic:Toc home loans.

What do we mean when we say ‘an identical variable P&I home loan product’?

We’ll match the rate on the competitor variable P&I home loan product if it’s identical to the material features of our Tic:Toc product and the competitor product is currently on offer (i.e. not an expired or past promotion or offer). If the other product doesn’t contain the features that ours does and has extra fees, Tic:Toc doesn’t consider this to be an ‘identical product’.

FAQs

How do I know if the rate I want to match is eligible?

Simple - it’s gotta tick some boxes.

The home loan rate you’re looking to match is eligible if:

- it’s an identical, publicly available variable P&I home loan product

- you’re purchasing or refinancing a live-in or an investment property

- if you’re refinancing, you must be refinancing a home loan from another financial institution (not from Tic:Toc, sorry)

- you’re applying for a home loan with Tic:Toc from 1 June 2022 (no retrospective applications)

- Still not sure? No problems - speak to our friendly Home Loan Specialists via our LiveChat or choose your preferred communication method here.

What do you mean by 'identical/like-for-like' product?

Not all products are made or structured the same.

When we say ‘identical’ or ‘like-for-like’ we mean:

- It must be a variable P&I rate

- Available for live-in homes or investment properties

- The product must be inclusive for loans up to 90% LVR (not the reward rates for lower LVRs in the market)

- It's a standalone product, which means it can’t be part of a bundle, package or multi-product offering

- There are no strings attached, for example, it doesn’t come with a cashback, gift vouchers or other monetary and product incentives

- It’s gotta be free of fees! No application, ongoing and annual fees - just like Tic:Toc

What do you mean by 'publicly available'?

Some lenders may offer rates outside of what is listed publicly, for example, it’s not publicly known or promoted on websites, ads or promotions. One-of-a-kind offers, you could say (aka under the table, privately negotiated, just for you kinda deals).

If the rate you’re trying to match is not available to the wider public (i.e. everyone), this means it doesn’t meet the definition of a publicly available variable P&I home loan product.

Will my matched rate be affected by rate movements?

This offer applies to variable interest rate products, and is, therefore, variable in nature. Short answer: yes.

Find out more about variable rates here.

When does the rate match apply? Can I keep requesting a rate match throughout the life of my loan?

The rate match is applicable once, at the time of application, which means, when you start an application which must occur from 1 June 2022.

Rate matches are made at the discretion of Tic:Toc and are applicable at the time of offer.

How and when will my rate match be confirmed?

Rate matches will be confirmed in your loan contract, which is as official as it gets (very legal, very spesh).

Why can't you match the rate on lower tier LVR bands?

As much as we’d like to our product and rate is structured as a ‘one-for-all’ which is inclusive of LVRs up to 90% to help borrowers with a lower deposit. Unfortunately this means the home loan product you’re referring to doesn’t meet our ‘identical/like product’ eligibility criteria.

Being rewarded for paying down your loan or having heaps of equity is great, so good on you.

Comparison Rate warning

Our rates are current as of 23 May 2022; available to all home loans approved on or after this date, and they can change. Our comparison rates are calculated for a $150,000 loan over 25 years. They factor in our fees associated with applying for the loan; our ongoing fees and our fees associated with leaving the loan. Our fixed loans roll to a variable principal and interest rate at the end of the fixed term. You can find all of our roll-to rates here. If the interest only period is not specified, the comparison rate is calculated on a one year period.

Got questions? Talk with us

^Terms, conditions, lending criteria, government charges & Comparison Rate warning applies.

Match is no bargain