Looks like UBank have dropped the rate on their 3Yr Fixed Owner Occupier home loan to 1.85% (down from 1.95%). It's now one of the lowest in the market for 3Yr Fixed.

If you are after other fixed lengths some of the lowest for 1Yr and 2Yr:

| Loan | Rate | Link |

|---|---|---|

| UBank 1Yr Fixed Owner Occupier | 1.79% | Ubank |

| St George 2Yr Fixed Owner Occupier | 1.84% (requires $395 fee) | St George |

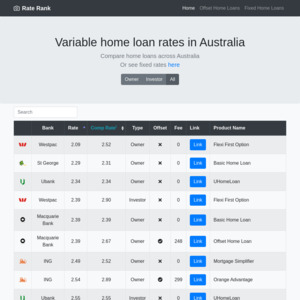

Other loans can be found on my rate tracker website: RateRank - Fixed | RateRank - Variable. Note I don't track every single bank, but most of the majors are on there.

TicToc (Bendigo Bank) has 3yr fixed owner occupier @ 1.96% CR.

I normally don't follow or contribute to these types of posts, but just recently refinanced and in my shop around found these guys.

Had a good experience, they have jack all fees, so thought I'd share.

https://tictoc.com.au/