Good to see Bundll jumping on the BNPL free food train - and a nice long expiry date

inb4 what is Bundll - you can read these posts and comments to get a good overview + what it's good for. Pro tip: you can use the Bundll Card to pay off a Zip Balance, and pay the Bundll off in turn with a Credit Card if you're really desperate for another 2 months of cashflow.

Unsure if it stacks with the $10 for a new user promo here: https://www.ozbargain.com.au/node/575987 active for another month

T's and C's:

The following terms apply to the Ribs & Burgers spend $10 get $10 back bundll new customer promotion.

Offer available to Ribs & Burgers customers who applied and got approved for bundll between 2 November 2020 and 14 December 2020. (“Customers") are eligible to receive a cashback of $10 on their first purchase at Ribs & Burgers using bundll (“Offer”).

Customers must spend $10 or more in their first single bundll transaction at Ribs & Burgers (“Eligible Transaction”) to receive a cashback of $10.

This Offer commences on 2 November 2020 and ends at 11:59 AEDST on 14 December 2020 (“Promotional Period”).

This Offer is subject to the Customer’s bundll account remaining open until the cashback amount is applied to the Customer’s bundll account.

The cashback amount will be applied to the Customer’s bundll account within 7 days of the Eligible Transaction.

This Offer is redeemable for one Eligible Transaction only and cannot be used in conjunction with any other offer. This Offer excludes Eligible Transactions that have been reversed or refunded.

The Promoter is ©2020 humm Cards Pty Ltd ABN 31 099 651 877.

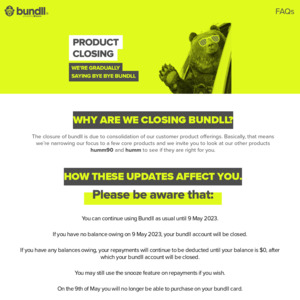

![[New Customers] Spend $10 Get $10 Back with Bundll @ Ribs and Burgers](https://files.ozbargain.com.au/n/65/578065.jpg?h=5254de28)

New customer only. It just means signup bonus, not as good as the offer before.