The RBA has cut the cash rate by 0.25% to a record low of 0.75% (Tuesday, 01 OCT 2019).

So, the home loan market is heating up, with various companies fighting for your debt.

Some are passing a bigger cut to you, some aren't.

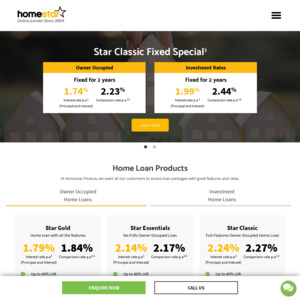

I just stumbled upon Homestar Finance and thought I would share with OzB community.

— Official Press Release (PDF)

PRESS RELEASE

FOR IMMEDIATE RELEASE

1 October 2019

HOMESTAR FINANCE IS PASSING ON THE THIRD RBA RATE CUT IN FULL

Following RBA’s announcement today to reduce the cash rate to a historic low of

0.75%, Homestar Finance will be passing on the full rate reduction to our customers.

Customers on our standard variable home loan rates will enjoy a further rate cut of

0.25% per annum, on top of the 0.50% reductions already passed on this year.

“As one of the oldest online lenders in Australia, we are continuing our commitment

to helping Australians achieve their dream of home ownership sooner and providing

a competitive edge amongst our peers” said Andrew Chepul, CEO of Homestar

Finance.

“Passing on all 3 rate cuts in full, shortly after each RBA announcement is only

one way we continue to demonstrate our commitment to our customers. While

borrowers have seen lenders talking about a “3” in front of their rate, we have been

providing customers with a rate starting with “2” since the July RBA rate cut” added

Mandy Sly, GM of Homestar Finance.

The rate reductions will be effective from 28 October 2019 for existing customers

and are effective immediately for new enquiries.

Have they been passing cuts to existing customers? Do they jack up rates for no apparent reasons?

Advertised rates mean little if they maintain margins on their back book (medium-long term mortgage customers) compared to front book (loans they have recently acquired).