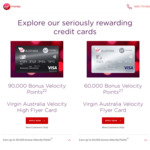

Seems like a good deal with a low fee - 60,000 Velocity Points for $64 + $129 Virgin Australia Gift Voucher by making an eligible transaction

$64 card fee for first year, then $129 from the second year

Receive 20,000 Velocity Points for each month you spend $1,500 on eligible transactions for the first 3 months.

First $1,500 each statement period gets you 0.66 Points per $1

Up to 44 days interest free

Minimum income $35,000

Minimum credit limit $6,000

Points will be credited to the Primary Cardholders Velocity Account up to 60 days after the qualifying purchases.

New customers only

Offer ends 31 March 2019

They've got a 90K bonus offer too, but requires to spend $3K a month for 3months.

Couldn't find out how much was the yearly fees…