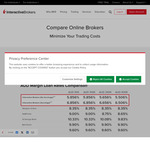

The rates have dropped since the recent reduction in the federal funds rate. It is the cheapest margin you will get in Australia.

Note that Australians specifically are still limited to $50,000 because the government thinks it is unsafe to invest in the stock market. They would prefer people lose their life savings in crypto or romance scams, or leverage like crazy to get millions of dollars in loans to buy investment properties here.

Do they do credit check?