Referral required to get the 150,000 points offer.

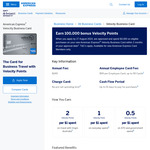

Welcome Bonus: 150,000 bonus Velocity Points

Earn 150,000 bonus Velocity Points when you apply by 8 October 2024 via this page, are approved and spend $3,000 on eligible purchases in the first two months from Card approval date. Plus, if you join the Virgin Australia Business Flyer program within 2 months of Card approval, you will jump direct to Tier 2 and receive a complimentary 12-month Velocity Frequent Flyer Gold Membership if you meet the eligibility and minimum spend criteria. Both offers are available for new American Express Card Members only. T&Cs apply.

The card has an annual fee of $249.

how do business cc's work? is an ABN sufficient?