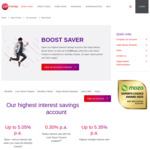

Just received an email saying Virgin Money is reversing the previously announced interest rate cut to their Boost Saver and will retain the 5.05%/5.35% (locked) rate.

Waiting to see if other BoQ HISA accounts follow suit…

From email:

Virgin Money is always reviewing rates to balance your needs with the fast-changing market conditions. We let you know earlier this month that we would be reducing the interest rate on our Virgin Money Boost Saver on Monday, 27 November 2023. However, given the recent decision by the RBA to increase the cash rate, we’ve decided not to proceed with the decrease and rates will remain unchanged.

This means that the rate on your Boost Saver will continue to be up to 5.05% p.a. when you meet the Monthly Criteria. If the Lock Saver Feature is enabled on your account and you meet the Monthly Criteria, your interest rate will remain at up to 5.35% p.a.

Previous deal - https://www.ozbargain.com.au/node/807795

4 min from email recevied to ozbargin post