Following on from yesterday's announcement about the imminent 0.10 percent reduction in the ME Bank HomeME saver account (https://www.ozbargain.com.au/node/807521), another Bank of Queensland brand - Virgin Money - is set to reduce their rate by 0.15 percent on their Boost Saver products (locked and unlocked).

Not happy Jan……especially against the background of a potential 0.25 percent hike in the official cash rate at the 7th November 2023 RBA meeting, due to today's inflation figures. I am posting this announcement merely as a 'heads-up' to OZBargainers to consider their current deposits/investments (and perhaps be ready to jump to something better.)

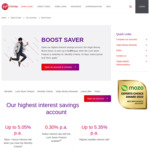

"Virgin Money regularly reviews the rates on our savings accounts. When we do this, we balance the needs of our customers and the changing market conditions. So, after careful consideration, we’ve made the decision to change the interest rate for the following product.

Effective, 27 November 2023, we will be decreasing the variable Bonus Interest rate on our Boost Saver by 0.15% p.a.

If you meet the Monthly Criteria your new rate will be 4.90% p.a. If the Lock Saver Feature is enabled on your account and you meet the Monthly Criteria, your new interest rate will be up to 5.20% p.a." - per an email sent to customers this afternoon.

The Accounts Leaderboard sets out what's currently available in the market. - https://docs.google.com/spreadsheets/d/145iM6uuFS9m-Rul65--e…

Previous deal - https://www.ozbargain.com.au/node/780947

Still have another rate rise left in us with inflation as high as it is.

Definitely vote with your feet if they're reducing their rates.

Still happy with Ubank