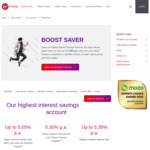

According to their Facebook page, Virgin Money (a member of the Bank of Queensland Group) will soon change the interest rates on their Boost Saver, up 25 basis points (0.25 percent). The new Boost Saver interest rate will be up to 5.05% p.a. when the account-holder continues to meet the Monthly Criteria. And, if the account-holder also enables the new Lock Saver Feature, the interest rate will increase up to 5.35% p.a. These new rates apply from 16 June 2023.

Following the RBA’s decision to increase the cash rate, we have an update on what this means for our customers. From 16 June, we’ll lift variable home loan interest rates by 0.25% p.a for new and existing customers.

We’re also helping customers smash their savings goals by lifting interest rates on our Boost Saver account from 16 June. Terms and conditions apply, visit our website for more information: https://virginmoney.com.au/bank-and-save/accounts.

To help you manage these changes, you can find more information, support and a range of useful tools on our website: https://virginmoney.com.au/rate-change.

Virgin Money unhelpfully doesn’t explain exactly how much the deposit rates will increase, but a official comment below the post on Facebook does:

The bonus component of the Boost Saver will receive the 0.25% increase.

As per @curt67’s previous deal at https://www.ozbargain.com.au/node/773699 :

Bonus Interest Rate and Monthly Criteria:

Additional variable interest rate earned on all your Boost Savers, up to a combined total balance of $250,000, in the same name as your Go Account when you meet the Monthly Criteria:

** Deposit at least $1,000 into your Go Account from another financial institution.

** Make at least 5 purchases on your Go Account that settled in that month (not pending).If you are under 25, the Monthly Criteria may be different. Refer to the Monthly Criteria in the Rates and Fees section for more information.

Notice Interest Rate:

Additional variable interest rate earned on a Boost Saver where the optional Lock Saver Feature is enabled.

** Provide 32 days’ advance notice to unlock your account or withdraw your money.

** This feature may be suitable for savings you don’t need to immediately access to. For more information, go to the Lock Saver Feature website page.Savings.com.au and Open Comparison Leaderboard provide information on other rates currently available in the market - https://www.savings.com.au/news/rba-savers-may-2023 and https://docs.google.com/spreadsheets/d/145iM6uuFS9m-Rul65--e…

All these offers with max balances, what about over $250k? Most ozbargainers have at least that much cash in the back/under the mattress.