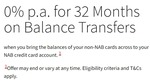

Following on from the previous OzBargain deal posted in December 2022, the National Australia Bank (NAB) balance transfer offer seems to be continuing - zero (0) percent per annum for 32 months on balance transfers when you bring the balances of your non-NAB cards across to your existing NAB Credit Card account.

"Promotional offer is available to existing NAB Personal Credit Card primary cardholders only for a limited time. Promotional offer is not available for balance transfers from another NAB Credit Card account or any current balance transfers with NAB. The promotional offer must be applied for online. No balance transfer fee applies."

Application must be made via the on-line form (per the link) and, if approved, my experience is that the balance transfer is processed against the NAB Credit Card within 2 or 3 business days. Each balance transfer amount must be $200 or more. The transfer amount can be anything up to your available limit on your existing card at the time of processing of the transfer.

Unlike the usual balance transfer offers made by other banks, interest-free days STILL apply to new purchases whilst you have an outstanding balance transfer/s if you pay the "interest-free days payment" (associated with the purchases) in full by the due date each month - https://www.nab.com.au/personal/credit-cards/balance-transfe….

0% p.a. BT for 32 months with no BT fee

-Available on a new NAB Low Rate card. This could help you to consolidate your debt and reduce the amount of interest you pay on it. Try using our balance transfer calculator to see how much you could save.

-Enjoy no annual fee for the first year (usually $59).

source: https://www.nab.com.au/personal/credit-cards/balance-transfe…

Not free for all cards. Corect me ìf I am wrong.