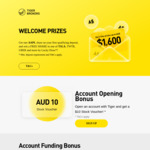

Get a Stock Voucher of AUD 10 once a new client successfully completes the Account Opening. Get one Apple share (Nasdaq: AAPL) and win a free share by lucky draw on your first qualifying deposit of at least AUD 3000.

The available stocks in the lucky draw game include Tesla Motors share (Nasdaq: TSLA), Apple share (Nasdaq: AAPL), Uber share (NYSE: UBER), Twitter share (NYSE: TWTR), Virgin Galactic share (NYSE: SPCE) and GoPro share (Nasdaq: GPRO). The clients will randomly receive one of the available stocks, which will range in value up to USD 1000. Most clients receive a stock bonus that has a value of less than USD 50.

Welcome Prizes Terms and Conditions

1) 1 Free AAPL Share (Deposit or Transfer of $3000 required) +

2) 1 Free Share of TSLA, AAPL, TWTR, UBER, GPRO or SPCE (Deposit or Transfer of $500 to $3000 required) +

3) 1 $10 Free Stock Voucher +

4) $0 brokerage for US & AUS shares for first 3 months

5) Cheap Currency Conversion Fee AUD ⇆ USD 37 BPS Per Transaction

6) After earning 3500 coins can buy 1 Alibaba stock for 10% off

7) After earning 4500 coins can buy 1 Meituan Stock for 10% off

8) Users who get the feedback email can get $80 or $40 Amazon or Coles voucher

9) Some users can get online feedback notification for $2 Stock Voucher

too good to be true? an AAPL share alone is worth over $200 AUD at the time of writing