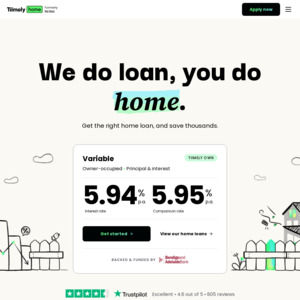

Great offer if your looking to refinance your homeloan.

Low interest rate and you can add a offset account for $10 per month.

They are backed by Bendigo/Adelaide bank so they are an ADI approved entity.

Tic:Toc cashback offer: Apply for a loan during promotion period 1 February 2022 and 28 February 2022 (‘promotional period’) + settle by 30 May 2022 to receive $2,022 cashback. Offer is available to eligible Live-in and Investment customers purchasing a property or refinancing from another financial institution. Minimum loan amount $300K. This offer is only available per loan. Cashback will be credited to your nominated bank account within 45 days of settlement. This offer may change or be withdrawn at any time. Excludes refinance of existing Tic:Toc home loan

Good deal. 1.89% and cashback.

Anyone have any experience with Tic:Toc. Do they treat their existing customers okay? Do they pass on rate cuts? (Not that we are going to get any of those anytime soon).