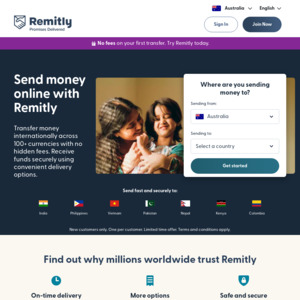

I recently used Remitly and found them very good. They seem to specialise in quick money transfers to non-first world countries. They support some of the smaller currencies which the major online transfer websites don't. And they get the money to the recipient's account very quickly at a low cost.

Mod: Added to referral system below. If clicking on referral link, and wishing to transfer to a country other than the Philippines, goto the bottom of the page and change the "Send money to" box from the Philippines to the country you wish to transfer money to.

Better than transferwise?