MyRate is offering OzBargain customers a $400 cash bonus on settlement of their loan. To be eligible for this offer, ozbargain customers must lodge their original enquiry online via this link.

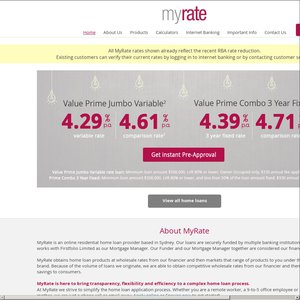

NOTE: MyRate is a direct lender, this means we deal direct with the customers and not through middlemen such as brokers. This means we can offer one of the lowest interest rates in Australia with no fees on standard applications.

Please note: The $400 bonus is a special offer for new customers only, i.e, none of the borrowers listed on the new loan can be an existing borrower on any other MyRate loan. In addition, to claim the $400 bonus, the customer’s original enquiry must be lodged from the link above.

What rate are you offering?