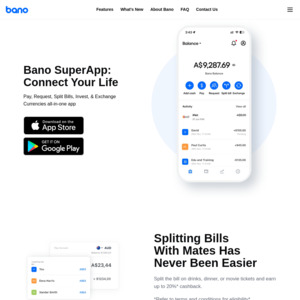

Found this new fintech startup and tried them. They're actually not bad, though for now, I'd only put small amount to take advantage of their cashback, in case they collapse like other startup recently. They do have a license to operate as financial institution, and their digital payment system is done by Nium, which is a big company overseas, as featured here:

https://finance.yahoo.com/news/bano-nium-enhance-digital-pay…

You do need to do KYC, with phone number and email to verify too, just like most bank account. But if you're afraid on the privacy side of it, pls don't try :)

Everything seems to be few minutes delay with them (including their PayId), but I got my account and virtual card up and running after ~15 minutes and another

10-15 minutes to have my PayId payment credited to play around. The bonus will be credited instantly after first payment with the (virtual) card.

For limited time, they also have a couple of decent cashback offering, the first one is guaranteed but changes every week and you can only see it on the app, once you registered.

E.g: last week one, expiring today (4-10 July), gives $10 back for $20 purchase at Gong Cha, Chatime & Sharetea. Next week (11-17 July) is $10 for $50 at Cotton On group, etc

Additionally they also have lottery cashback of 'up to 20%' with their split bill feature (similar to UP slicing). I tried a few times paying online bill, got ~1% paying my utility bill and 0 when I repeat (maybe because they detect the same merchant), so not counting too much of it. You need to split with other Bano user to try your luck:

https://bano.com.au/split-bill/

![[iOS, Android] $10 for Referrer and $10 for Referee after First Virtual Card Usage @ Bano](https://files.ozbargain.com.au/n/64/711564.jpg?h=4e178a59)

1.8% cashback on everything? Any catches?