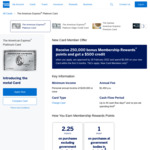

Best AMEX Platinum sign up bonus I've seen in a while. Also comes with $450 AmEx Travel Credit per year.

I've seen 350,000 bonus points but not with the $500 cashback.

Eligibility: Offer available to those who have not held an Amex in the past 18 months. Personal annual income of $100,000 or more.

That annual fee though!