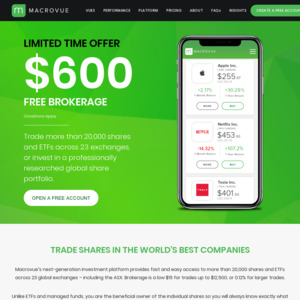

$600 in brokerage credits for ALL NEW TRADING ACCOUNTS approved between 27 August and 12 October 2018.

Who is Macrovue, and why should I invest with them?

- Directly trade in over 20,000 shares and ETFs across 23 global exchanges – including the ASX

- Invest in professionally constructed share portfolios, centred around growing trends like Artificial Intelligence, Luxury Goods and Clean Technology

- Trading accounts are free to set up. Our application process is fast and completely online (including the W8-Ben form)

- Once your credits are used up or expire, brokerage is a low $15 (AUD) for trades up to $12,500, or 0.12% for larger trades

- EOFY tax reports provided

- …and we're an Australian company with an AFSL, 256-bit platform encryption and a relationship with one of the world's biggest retail brokers!

Offer conditions:

- $600 worth of brokerage credits are applied to all new trading accounts approved between 9am AEST 27 August 2018 and 5pm AEST 12 October 2018

- Credits are applied on the date the application is approved, and are valid for six months

- Unused credits will expire six months after being credited

- Credits can only be used towards brokerage costs and are applied to completed trades

- This offer is not redeemable for cash and is not transferable

- Macrovue reserve the right to terminate this offer or amend these terms and conditions at any time without notice.

Damn, already signed up to selfwealth with 5 free trades :(

What do you mean by "Invest in professionally constructed share portfolios, centred around growing trends like Artificial Intelligence, Luxury Goods and Clean Technology"?

Do you have pre-set portfolios for us ready to buy?