Budgeting for Crowdstrike outages can be difficult, but with a good spreadsheet you too can avoid financial bluescreens.

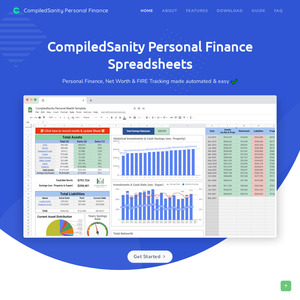

This formula driven and automated net worth and savings tool has been really popular on OzBargain and reddit, and hopefully you'll enjoy it too! The sheet is made to help track monthly finances and provides a bird's eye view of your financial position each month. For example, I was able to see that if I had invested in NVIDIA in 2019 I wouldn't really need to track my investments anymore.

Changes since the last deal – many bug fixes per community requests including improvements to recording a month, super/live asset tracking, general usability improvements.

——

FAQ #1: Why should I pay money for this?

The sheet is heavily automated, has live pricing and is a one-off payment rather than a subscription. If you're really interested, feel free to join the subreddit where I take future feature suggestions (and have for the past two years) and other users can help you debug and get set up.

FAQ #2: what permissions do I need to give and what information will you get off me?

All information is fully self-contained within and never leaves the sheet.

There are 2 versions of the sheet:

- FULL: Sheet contains the full suite of automated features but requires some more expansive permissions as a result.

- SLIM: Does not support email updates, calendar reminders or the migration feature but has more self-contained permissions for those privacy conscious.

Further FAQs can be found here

——

Wishing you all a happy tax refund and start to the new financial year!