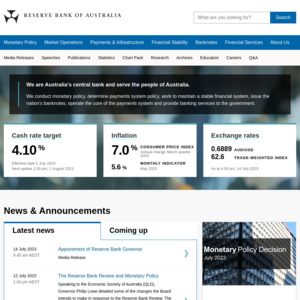

The RBA have announced its 9th consecutive rate rise in a row

https://www.news.com.au/finance/economy/interest-rates/rba-i…

Interest rates a ~4x higher then they were pre-pandemic in December 2019 the cash rate was 0.75% it now is 3.35%

We have about 1/3 of home loans coming of 'fix terms' this year meaning the 'actual' affect of the rate rises have not be felt but a lot of borrowers

now before the Karens post

a. in 1990 interest rates we 21%

or

b. you should of seen this coming

no one cares you paid 21% on your $30,000 home loan

literally no one and i mean no one could have seen this level of interest rate hiking happen in such a short period of time this is history making speed rates are rising - keep in mind the high inflation is also hurting borrows so it is a double hit

of course we need to combat inflation but im posting to see how this will affect people who are 'borrowers' like myself - i know a few people that are 'really' feeling the pinch and wanted to say there is support out there via financial stress hotline and you can contact your lender for support regarding your situation if you are finding yourself in trouble

Err, that's just not true.

Anyone with even a passing understanding of economics knew this would be the end result.

Money has been essentially free (cash rate at 0.75%, basically interest free at that rate) - this was guaranteed to create significant inflation.

Our economic systems manage inflation through interest rates.

There was never going to be a different outcome.