Quality health cover, plus rewards available at Qantas Health for insurance. Also there’s the Wellbeing app to get free points for sleeping, walking, cycling, checking your smoke alarms and more.

Offers end 31 March

Win one of 10 $2,000 Qantas Hotels vouchers for getting a quote using your Qantas Frequent Flyer number.

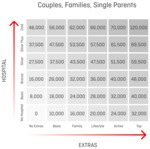

Earn up to 120,000 Qantas Points when you join. Singles Points Table - Couples Points Table

Skip the 2 & 6 month waiting periods on Extras when you take out combined Hospital and Extras cover.

Points will be awarded based on your level of cover after 60 days. Points and waive waits not available if you’ve recently held health insurance issued by nib.

Bonus: If you use a referral code from ozbargain (on this page), you can get an extra 5,000 points!

Personally, every year that I’ve used it, I’ve claimed back more than I paid in premiums, PLUS I earned Qantas Points! However, each applicant should consider their own personal situation and whether the insurance is the best option for them and their family.

Get your phone ready for the inevitable phone call from Qantas Insurance after doing a quote online…