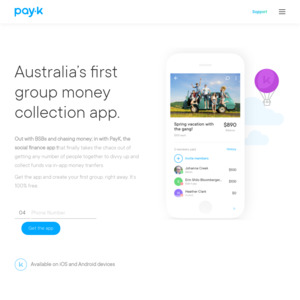

Introducing PayK

Hi OzBargain!

I'm Jan from PayK, and I'd love to introduce our new app to you, get some feedback, and answer any questions you might have. Feel free to ask anything in the comments, more than happy to oblige.

PayK is designed to make it simple and effortless to collect money with anyone for anything. We’re making group finance simple with instant, temporary wallets for any purpose, with realtime transparency, automatic reminders, and, benchmark security. All 100% free.

To use PayK, all you need is a goal, and a group of people. For example: Going away gift for Hannah with Tim, Matt, and Sarah. Here’s how it works.

- Create a group, name it, and invite everyone involved, we make it easy with direct messages, or a shareable link.

- Watch as they contribute funds instantly using any Australian Visa or Mastercard, you can see who’s paid and who hasn’t in realtime! And if anyone’s slowing the group down, you can ping them with notifications right from the group screen.

- When everyone’s chipped in, simply withdraw the full amount to your Australian bank account, totally free, and get on with your life without the burden of social debt, scanning statements, or handling cash.

And that’s it. Simple, painless, and super fast. Perfect for gifts, holidays, dinners, barbecues, sharehouses, bucks or hens nights, or anything else where money between groups always sucks.

Specifically for this forum, I will add some extra details. You can process payments into a PayK group with zero fees using a Visa or Master debit card, we accept credit and charge cards also, but cannot guarantee that the issuer will not charge an advance fee, if this happens - let us know. We're trying to get rid of them. Withdrawals are paid by direct transfer into your nominated Australian bank account, and we do not take any clip on these either. AMEX is not currently supported, but we are adding methods such as Poli soon. We do not serve ads, monetise data, or plan to charge usage fees for consumers. Revenue will be based on merchant services. Our payment security is handled by Australia Post's SecurePay and your details are encrypted and hashed with PCI-DSS Level 1 compliance. Hope that helps.

PayK is available for free on Android or iOS, and if you need any help getting set up, call our support line during business hours at 1800 729 528 (we’ll even set up your groups if you’re feeling lazy!)

Enjoy!

Already a crowded space with the likes of beem it and finch, what's different?