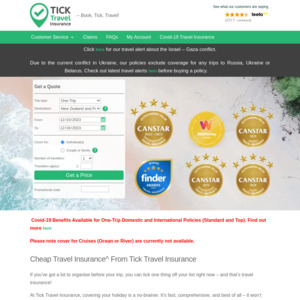

Tick Insurance are offering 15% off new policies due to recently being awarded as Canstar 2022 Award Winner for Outstanding Value.

Their Standard and Top Cover policies do cover COVID-19 and seem to have higher general inclusion values than CoverMore or World2Cover, albeit with higher $200 default excess.

Expire Date: 31/12/2022

Booked with them before as the PDS inclusions suited my needs, but haven't needed to make a claim. YMMV.

Get a credit card with complementary travel insurance?

Or a debit card (NAB or Commbank, 10 per month fee) with complementary insurance.